Precautionary Savings – It's High Time

The majority of the population in Israel lacks significant precautionary savings and thus are not capable of dealing with Mega-Macro Shocks - mandatory precautionary savings should be put in place for all citizens for use during such a crisis.

COVID-19 pandemic brought enormous costs in lives and in livelihoods. The two are connected, as the gigantic economic cost is affecting decisions on how to deal with the medical risks. In dealing with the economic challenges, the government faced four very challenging tasks:

- To support the individuals, employees, self-employed and small business owners, whose livelihood was halted as a result of the lockdown or other government actions to curb the infection.

- To help viable businesses survive a period with forced lockdowns.

- To jump-start the economy.

- To preserve social cohesion and trust in the system.

Since, as shown below, the majority of the population in Israel (and elsewhere) lacks significant precautionary savings; less than 20% of the population have such savings that can sustain them for over 6 months of lost income. This implies that in times of a crisis the government must step in, but since it lacks detailed information about such savings and the degree of damage incurred by various individuals during the crisis, performing the tasks cited above presents a serious challenge. Public anger and the associated political pressure created stress on the government precisely at a time when its revenues drastically declined, leading to bad decisions, waste of resources, as well as bad incentives for hundreds of thousands of people.

We argue that the existing systems of shock absorption through unemployment insurance and existing structural saving schemes are not capable of dealing with Mega-Macro Shocks (MMS). The traditional unemployment insurance system (UI) operates by pooling uncorrelated non-systemic risks; thus it can offer no protection against MMS, when the shock is shared by the entire economy (or even the world) and is on a very large scale. Under normal circumstances (unlike the current crisis, which was more of an exception, rather than a rule), such a shock can lead to a sharp rise in the risk premium for the government, making it difficult to finance additional needs through borrowing in the international financial markets.

The standard government tools designed for day-to-day management of risks are of little help during MMS:

Unemployment insurance (UI) works well in routine times against individual unemployment spells by pooling uncorrelated risks, but collapses under MMS, resulting in budgetary support. Similarly, the welfare system incurs significant budget outlays during MMS.

MMS, e.g., 10% of the GDP, is extremely painful if it must be absorbed in a short period of time. However, if we allow the adjustments over the course of a 40-year period, then it becomes an annual cost of 0.25% of GDP, which is not a dramatic event especially taking into account a partial recovery of the GDP in subsequent years. The question is how to translate the enormous damage generated by a relatively rare MMS event, into a tolerable income decline over the lifetime.

Two paths may be taken by a country to address MMS:

- The more traditional path is to spread the cost over the generations that follow the shock by borrowing during the crisis. The variance of consumption between the before and the after-crisis period is high, and so are the borrowing costs of the government during the crisis. The government's decision-making process is subject to significant political pressures and severe time constraints; thus, its quality and long-term consequences are problematic.

- A better idea is to spread the cost of this shock over the lifetimes of several generations by instituting mandatory precautionary savings for all citizens for use during the crisis, in addition to the possibility of borrowing. This spreads the pain over many years BEFORE AND AFTER the MMS. This is self-insurance vehicle that minimizes the consumption variance. This is a welfare improvement for all risk-averse citizens. In addition, it makes the country much better prepared to make tough decisions during the crisis, by giving it time to regroup and respond in a rational way.

We argue that the second option generates a superior outcome for the country, and propose a way to operationalize it below. At first, it may seem complicated and perhaps unnecessary, but we urge the reader not to dismiss it offhand, but rather weigh the costs of small and manageable additional complexity, against the benefits of welfare improvement and better decision making, which are quite high. We must not forget that the Covid-19 shock has been rather forgiving to Israel in terms of the country's ability to borrow. We faced a very low interest rate and risk premium environment. If the shock were due to a major war, or a mega local event in the context of a high interest rate environment, the difference between the two options above would become much greater. .

Spreading the cost of a shock using the most obvious tool – buying insurance in the world markets and paying premia in advance- is not feasible in an MMS. One cannot insure against worldwide negative shocks at reasonable rates. Local MMS are costly, or in some cases- impossible to insure against, apart from a tail risk, and the insurance will not cover wars.

Therefore, the only available tool is precautionary savings over the lifetime of the generation. This again can be achieved in two different ways: precautionary savings at the government level, or at the individual family level - having every family maintain short-term precautionary savings that allow it to weather a loss of income for several months, without drastically lowering their quality of life.

Theoretically, the government could create a State fund that could provide precautionary savings. In fact, many governments do, and the GOI did establish a Sovereign Wealth Fund partially to create such aggregate savings. However, there are three caveats. First, the SWF will accumulate sufficient resources to address an MMS only in 15 years, at the earliest. That, if it is not used up by the government to cover costs of maintaining a coalition, or to accommodate additional budget demands from the defense establishment. Thus, if these concerns are refuted in 20 years we can rethink the concept, but in the meantime, the country cannot count on it.

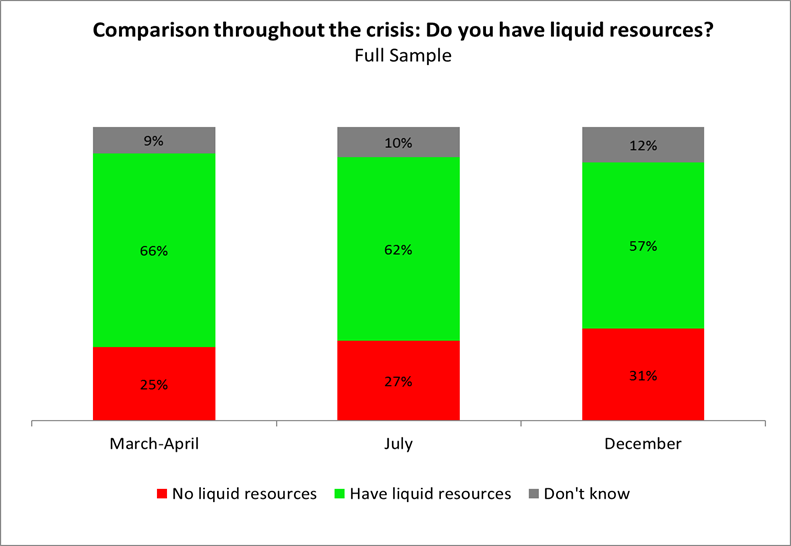

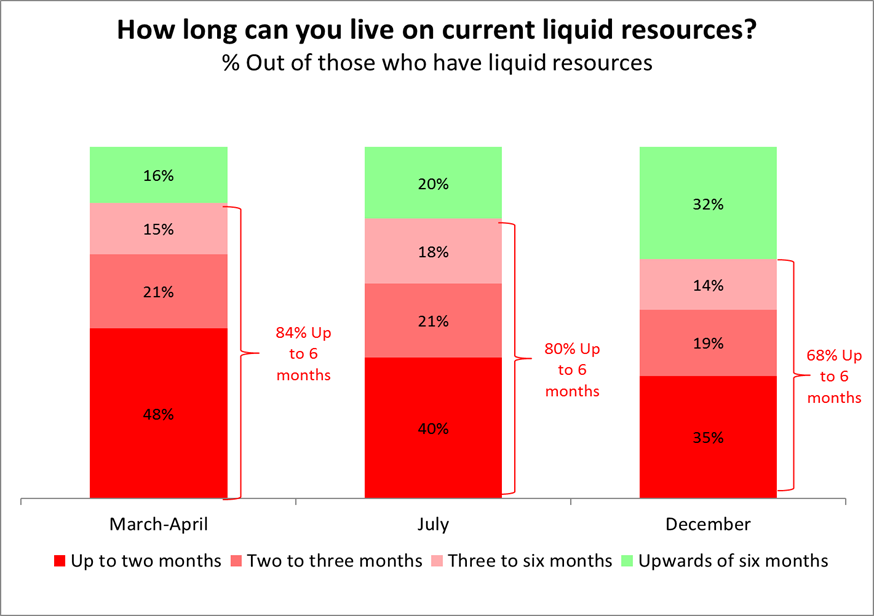

Thus, for the next couple of decades, the only feasible way to create precautionary savings is by mandating and subsidizing them at the individual level. This is not a new concept, as every financial advisor suggests having such precautionary savings to their clients. Unfortunately, people seldom have sufficient savings. In fact, in the US, 25% of the respondents to a question: “Would you be able to come up with $2,000 in 30 days?”, said definitely “No!” and another 25% responded with a “Probably not!”. Recall that $2,000 is not a large enough amount to last for a few months without an income. In Israel, in three surveys conducted by the Israel Democracy Institute in April, July and December 2021,) respondents were asked whether they have liquid resources to bridge over a period without income due to COVID. As in the US, in April about 25% responded that they possess no liquid funds at all, and this share rose to 31% by December. Of those who did have some liquid funds, about 40% said these funds can sustain them for up to 2 months without income. In fact, only about 18% reported that they could weather a lack of income for more than 6 months.

It is clear that a large percentage of individuals do not have adequate precautionary savings. We argue that the government can create a significant improvement in dealing with the next MMS by mandating precautionary savings, that are owned by the family, similar to a pension account, but are either restricted till retirement, or, in the case of an MMS, can be activated by the government. This will allow those who had been adversely affected to use them, helping the citizens to maintain their standard of living, as well as allowing the government to focus on restarting the economy, and not on providing life support to a large proportion of the population under very difficult economic circumstances.

We propose, therefore, to mandate a special Precautionary Savings Account (PSA) for every citizen who begins contributing to a pension fund, so that eventually everyone accumulates savings that are sufficient to provide the level of pre-MMS after-tax income for a number of months (N). The number N initially increases with age, as responsibilities grow, and then declines, as the needs decline and the labor income is replaced by a pension, as suggested in Table 1.

This account is assigned to an individual and is independent of her place of work, or residence. During MMS the government can authorize the use of these savings, and individuals will decide whether they want to use them or not. The remaining balance in the account is rolled into the pension plan at retirement.One could consider releasing the use of the accumulated savings in the PSA in the event of a severe personal need (such as illness). This would require the determination of clear criteria, and the setting up of a special unit to review and authorize the release the use of the PSA, or the reliance on another government agency such as the Social Security Administration to administer this operation.

It is possible to use the ROR guarantee for the first 60,000 NIS of this account to reduce the volatility; the rest can be invested in the market with low risk and high liquidity and is hedged against a local crisis through a high percentage of foreign liquid investments.

The government must participate either through tax deductions, or through direct contributions for people with lower incomes, which gives it the right to impose conditions, such as it does in the case of pension law, Provident funds, etc.

Figure 1 Availability of Liquid Resources Over Time

Figure 2 % of Those Reporting Liquid Resources

Source: Israel Democracy Institute, January 2021

Table 1: Number of months of net income in the account

|

Age |

Number of months of accumulated earnings (after taxes) |

|

22-26 |

Steadily increasing to 6 months, using a fixed percentage of earnings. |

|

27-32 |

Increasing to the steady state level at 33 |

|

33-50 |

12 |

|

51-60 |

10 |

|

61-70 |

8 |

|

71+ (if working) |

6 |

|

Retired |

0 |

*

The PSA obligation is proportional to income, but has a cap, above which the preparedness for MMS is the personal responsibility of the family. This cap can be, for example, 2 times the average wage, beyond which the individual may, but is not required, to save in this account. Thus a 52-year-old earning 40,000 NIS a month in gross income (25,000 NIS net income), will be asked to maintain at least 8*2*11,000 (average wage) = 176,000 NIS in this account. A 26-year-old earning 6,000 NIS (5500 NIS net income) will have to accumulate and maintain 6*5,500=33,000 NIS. Finally, a 35-year-old, whose pre-tax salary 30,000 NIS (20,000 NIS after tax), will have to accumulate at least 12*20,000=240,000 NIS. These amounts are significant enough to allow a family to maintain its standard of living for many months without a steady income, while at the same time, not too large relative to their other savings. For the three cases above, these amounts represent 2, 2.5, and 3.5 years of pension savings, respectively.

As the PSA insures against events that cause widespread loss of work income, we propose to divert part of the existing regulated savings – first, the Provident Training funds, and some of the pension savings - into this account until it reaches the mandated balance. If the MMS event does not take place, the funds are automatically rolled into the pension account of the same individual (after accounting for the fact that the individual is not continuing to work) and are treated in the same way as the existing funds in that account. Similarly, as the number of mandated months in the PSA account declines, the released funds are added to the pension.

Since pensions ensure a steady stream of income which is not conditional on the state of the labor market, retired individuals should not be mandated to have such an account. An interesting question is whether to force people who choose to work after their retirement age to continue saving in the PSA. We propose to mandate some form of precautionary savings for them as well.

As stated, the balance of the PSA fund is transferred to the pension savings vehicle of the person’s choice at the time of retirement.

Sources of Funding

The main question is how to finance these accounts, so as not to significantly reduce the disposable income of various groups in the population, especially those that cannot afford such a cut.

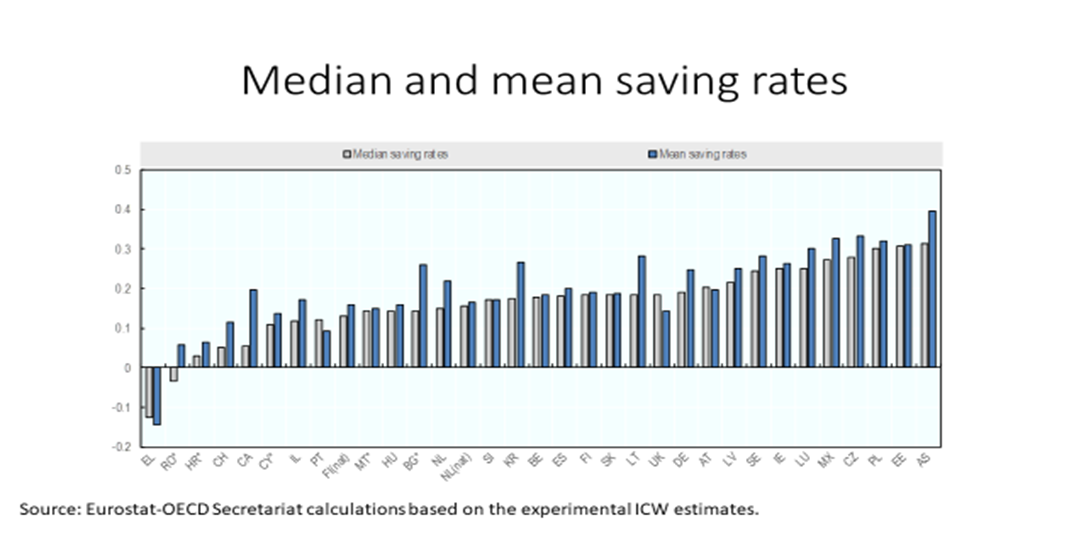

First, we need to ask ourselves whether the overall savings rate of the Israeli population is sufficiently high, or needs to be increased. Figure 3 shows that the average savings rate of Israeli households in 2015 (the last year for which comparative data exists)—that is, 18%- is slightly lower than the average in OECD countries, that is, 20%. The median savings rate is only 12 %, compared to the median rate in OECD countries, that stands at 17%. However, since 2018, with the progress, in implementing the compulsory pension law, it is reasonable to assume that the average household savings rate in Israel has increased, and is now probably close to that in the OECD.

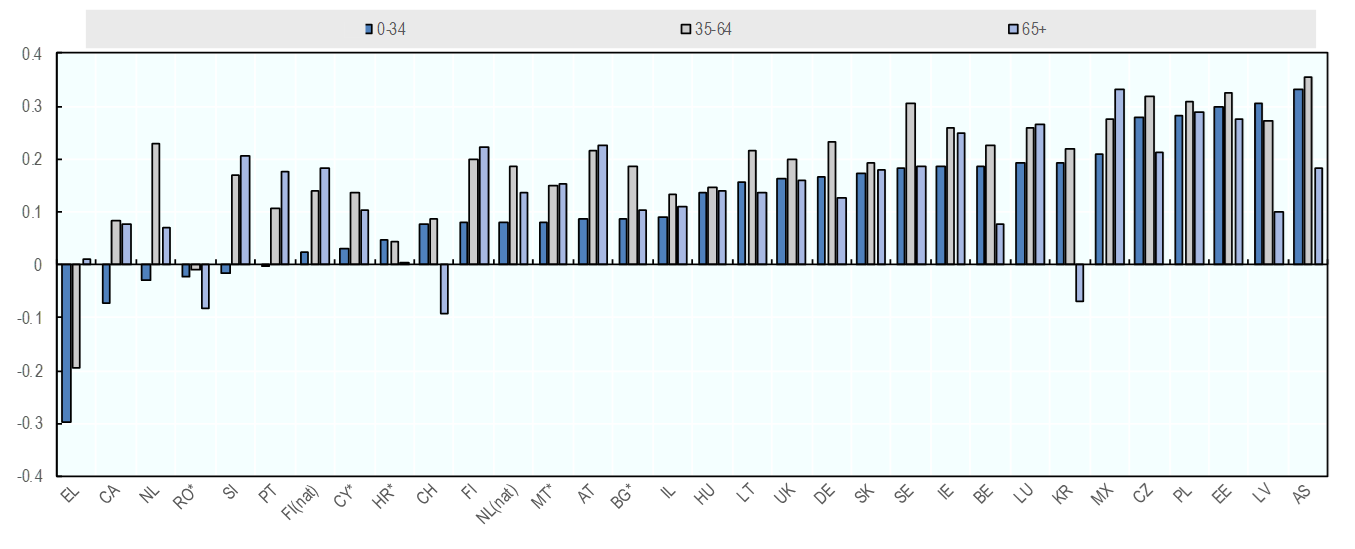

Figure 4 shows that the Israeli savings rate for ages 35-64 is similar to that in OECD countries, while those Israelis aged 65+ have relatively low saving rates. This may be the result of lack of work pensions for many in retirement, while the new pension law requires working age individuals to save for retirement. It may also be not taking into account the relatively high percent of individual investment in residential real estate in Israel, that substitutes for pensions.

Figure 3

Figure 4

Savings rate by age group

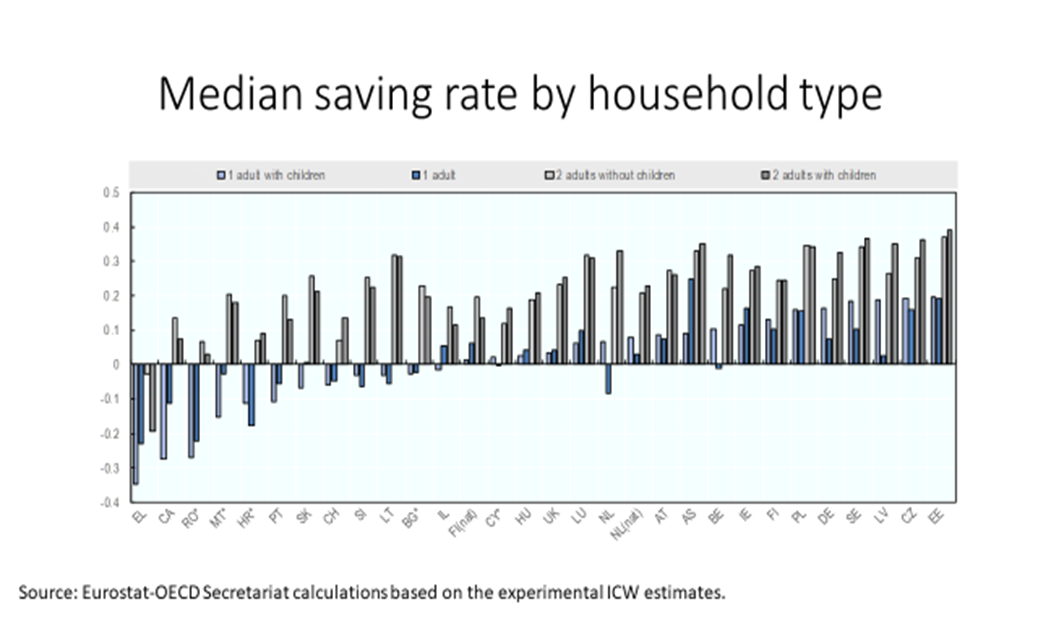

Figure 5 presents a comparison by family type: while saving rates of families with 2 adults and 2 children are similar to those in OECD countries, savings rates of larger families are much lower. It is important to note that the prevalence of large families in Israel is particularly high, and unlike in most developed countries, family size is much higher among the lower income families, which is reflected in the lower average and median saving rates of Israeli householdsTo alleviate the effect of the low savings rate on the next generation, the GOI introduced a savings scheme "Saving for Every Child" where it deposits a certain amount for every child under 18..

Figure 5

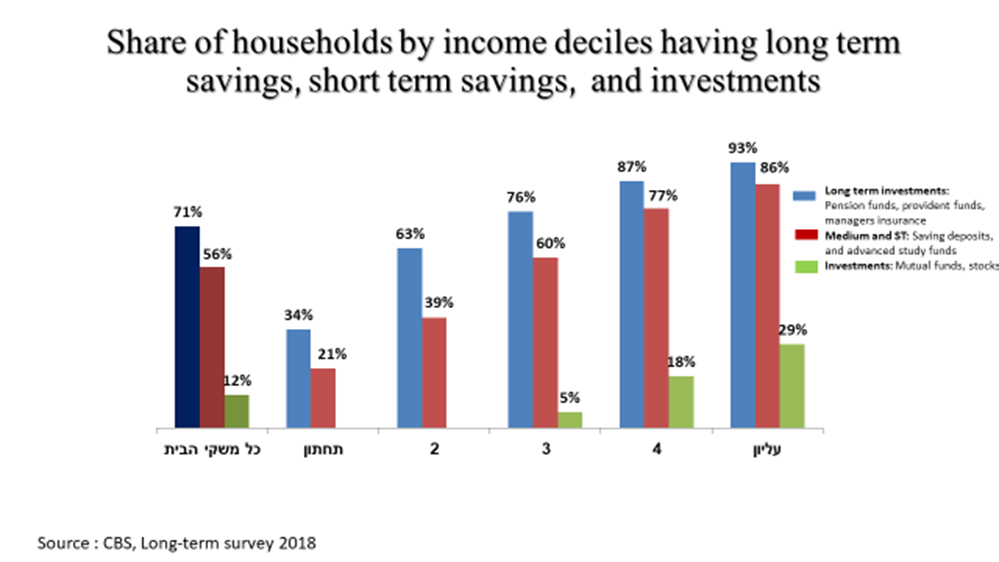

To assess the need for additional household savings to finance PSA accounts, we need to consider not only the average and median savings rates, but also the entire distribution of saving rates by income and the type of savings from disposable income. Although data on the precise saving rates by income level is unavailable, information on the prevalence of savings, by type of savings by income deciles in Figure 6 reveals large differences in the pattern of savings. While above 90% of households of the upper income decile have long-term savings (Pension funds, provident funds, manager's insurance) and 86% have medium and short-term savings (saving deposits, and advanced study funds), only one third of households in the lower decile have long term savings and one fifth have some shorter-term savings.

This indicates that a reasonable course of action is not to dramatically increase the savings rate for all, but rather to follow a differential approach:

- Reallocate the existing savings into PSA accounts for those with a relatively high income and high savings rate, and who already benefit from significant tax benefits on these savings.

- Reallocate some of the pension savings of low-income families, while supplementing them with a greater government support – comparable in percentage terms to the tax benefits of the higher income populations.

Figure 6

It is important to educate the citizens that these savings are partially financed by the government for the purpose of helping them to prepare for MMS ahead of time, and that only the government can authorize their use during the crisis.Hard times can be defined as the aggregate shocks, or a severe illness of an individual. To make it acceptable to lower income populations, the government provides part of the funding for them. These contributions will not be subject to social security payments.

One might raise a concern that the PSA may lead to crowding out of other savings. However, as most of the process is based on the reallocation of existing savings, this does not seem to be a major issue. For those without precautionary savings, this is likely to increase the overall savings, given the increased government contribution. For those with some precautionary savings in the form of Hishtalmut funds, we expect them to be replaced to a large extent by this account that would be used only in the event of the MMS. This is likely to cause an increase in savings to hedge against personal liquidity events.

Another question that may arise is why not allow people under a mega-shock circumstance to borrow against their pension savings, or access their Hishtalmut funds instead of setting up PSA accounts? This is not a feasible solution under the MMS as pension funds, that are geared to invest for very long periods of time and distribute savings gradually, should not be asked to change their investment strategy to achieve a completely different goal. They are not equipped to quickly release large amounts of money in a very short period, and their liquidation of assets in a relatively small market may have macro effects that the government cannot control. Moreover, many individuals have multiple pension accounts; coordination among them would be a nightmare. A dedicated account that can be either open or closed, allows to distribute funds easily and quickly, with minimal bureaucracy. Regarding the use of Hishtalmut funds, currently only about 35% of employees have such a fund, and most use it every 6 years for consumption purposes. We propose to redirect some of these savings into the PSA accounts, keeping the rest untouched.

As a first pass, we propose to fund PSA accounts as follows:

- Individuals with higher incomes:

- That have Hishtalmut In this case, a proportion from the existing balances as well as all the new contributions will be transferred to PSA accounts, until the required balance is reached. The government is already participating in these savings through the income tax exemptions.

- That don’t have Hishtalmut funds but have pension savings – will be asked to contribute to this account from their mandatory pension contributions – partially from the existing balances, and from the current contributions. Again, the government is already providing them with support through tax exemptions.

- Those without Hishtalmut or a sufficient pension fund (mostly self-employed and business owners – who only recently started contributing to their pensions), will be mandated to open a PSA, and contribute to it (initially as part of pension savings plus some more) until it reaches the necessary balance. The government must award some degree of an temporary tax exemption to these individuals to justify the restriction on the use of their personal savings.

- People with lower incomes: tax exemptions provide too little or no support at all; at the same time, reducing further their disposable income is not a solution. On the other hand, the amounts the need to be saved are much smaller. Therefore, we propose:

- At the lowest levels of income, the current mandatory pension law provides more than a 100% replacement ratio on reaching pension age. Thus, part of their pension contributions, matched in some proportion with direct government contributions to their account could be a good way to fund most of PSA accounts.

- A large part of the pension savings of workers under 30 with lower incomes should go to their PSA account. One can envision special tax benefits for them, whereby they can defer part of their taxes/SS benefits with some small interest, directing them instead into the PSA. This will place less of a burden on their budgets as well as the government budget (spending) in earlier years. In many cases, with time their income will rise, making it easier for them to repay the taxes

- One way the government can finance its direct contribution is by raising the negative income tax for low income workers and diverting this increase to PSA accounts, without the need for a person to apply – based only on the administrative data. This will increase the incentives to work, while increasing precautionary savings at the same time. For older workers, an increase in disregard can be diverted to PSA accounts as well with similar effect.

- A challenge may arise at somewhat higher levels of income – around the average wage and somewhat above, where many people don’t have a Hishtalmut fund, but their replacement ratio at pension time is not high. Here the government will have to help them reallocate some of their pension savings, while at the same time providing higher tax benefits so not to drastically reduce their pensions in case of an MMS>

The distributional impact of the proposed scheme depends on the degree to which the government subsidizes these savings for lower income families, which we believe is not too costly if one does it in a well thought-out way.

Management

Day-to-day management of these accounts must be simple and efficient. We believe that the Social Security Administration can maintain the roster of the PSA and operate the disbursement when the government allows it. SS is managing millions of personal accounts in its system anyway, thus this would entail only a small increase in costs. Management of funds can be done by outside contractors who win tenders published by the Ministry of Finance, under the supervision of an advisory committee. Citizens can choose which manager to go with and can change every few years. The investment policy will be restricted according to the principles set by the advisory committee. PSA balances cannot be invested only in the Israeli market and cannot be overly reliant on the Israeli government bonds. PSA accounts must be liquid during an MMS and hedged against Israeli-specific MMS, which implies that they must be invested in a portfolio of high-grade foreign government bonds, taking into account the exchange rate and Israel sovereign risk.

As an alternative for the tender, these accounts can be managed together with the Bank of Israel reserves, and in times of crisis, the Social Security Administration will evaluate the total needs and disburse the amounts, while the BOI will provide immediate liquidity without the need to immediately sell the assets.

Summary

To sum up, we believe that this proposal, if implemented, will reduce the economic and social impact of the next global pandemic or any other MMS that could potentially paralyze large parts of the economy and society. If people had PSA accounts in 2020, introducing a tight lockdown, as was required to reduce the spread of the disease, would have been much easier, reducing both the health challenge and its grave economic impact. We can achieve this outcome at a very low cost during the next pandemic.