Checks and Balances, Public Corruption, and Economic Development

Increased corruption and damage to Israel's economy - four simple figures with important lessons for Israel’s judicial overhaul

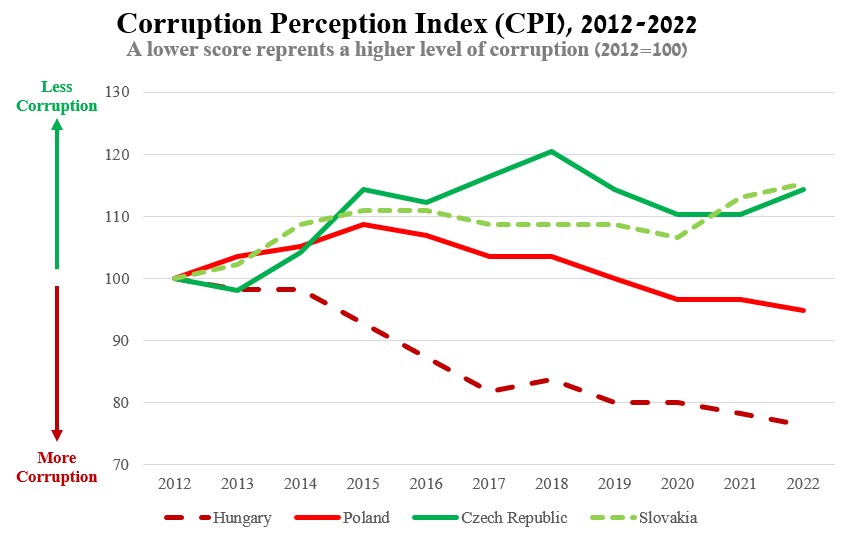

Figure 1

The 2022 CPI (Corruption Perception Index - CPI) world rankings were published in January 2023. Transparency International calculates the index based on the perceptions and evaluations of experts and business people on the level of public sector corruption in their country. The index encompasses data from various independent sources that conduct surveys with specific questions aimed to measure different forms of public sector corruption. The index ranges from 0 (highest level of perceived corruption) to 100 (lowest level).

While Israel’s ranking consistently dropped during 2016-2021, in 2022 its ranking rose for the first time in five years. Justice Nili Arad, who chairs the Israel chapter of Transparency International, explained that Israel’s improved ranking in 2022 stems from the insistence “on a strong and independent judiciary, on investigating and indicting cases of political corruption, on the independence of the Attorney General, on the protection of gatekeepers, and on freedom of the press.”

Nowadays, it is difficult not to think about Arad’s explanation for the upturn in Israel’s ranking in the context of the Netanyahu government’s plans to overthrow Israel’s current form of government. The public discourse in Israel frequently looks at Hungary and Poland as relevant case studies from which lessons can be learned. In Hungary, the Fidesz party headed by Viktor Orbán rose to power in 2010, and in Poland, the Law and Justice Party (PiS) rose to power in 2016. What happened to the levels of corruption in these two countries since these parties came to power?

The above figure plots the levels of perceived corruption in these two countries, as well as two neighboring countries for comparison – Slovakia and the Czech Republic, during 2012 – 2022 (The CPI’s methodology was changed in 2012, rendering CPI scores per- and post-2012 not comparable. In Hungary, the CPI has been consistently declaiming (i.e., the perceived level of corruption increased) throughout the study period, in which Orbán has been in power. A similar pattern is observed in Poland starting in 2016 when the PiS party rose to power. In contrast, in the comparison group, the Czech Republic and Slovakia, their ranking in the corruption index rose. These results should be taken with a grain of salt. The relationship between the changes instituted by Orbán in Hungary and the PiS party in Poland and the increase in corruption observed in these simple time series does not necessarily represents a causal relationship. Yet, the data does paint a worrying picture and gives us a good reason to pause and seriously consider the likely effects of the constitutional and judicial changes planned by Netanyahu’s government.

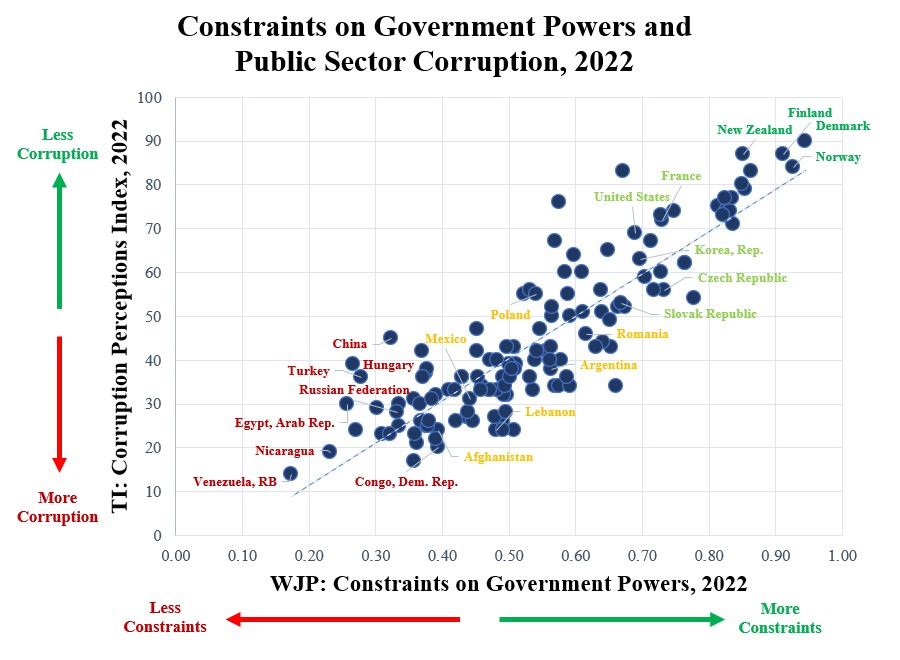

Figures 2-3

Given the above, is there a good reason to suspect that there is a real causal relationship between the connotational changes in Hungary and Poland, which removed checks and balances on governmental power, and the increase in corruption in these counties? The following figure suggests that the answer is positive. The figure documents a strong positive relationship between the degree of constraints imposed on the government and the level of public corruption in a large sample of countries. Data on the constraints on government powers come from the Rule of Law Index of the World Justice Project (WJP). It measures “the extent to which those who govern are bound by law,” taking into account both constitutional and institutional factors, such as judiciary independence and its effectiveness as a constraining factor on the government. It also considers non-governmental factors, such as a free and independent press and civil society organizations’ ability to freely monitor and comment on government actions. To measure corruption, we used the Transparency International (TI) data mentioned above.

The evidence presented in this figure is correlational, as in the first figure. It shows that public corruption and an unconstrained government go hand-in-hand. The lower the degree of effective constraints on government powers in a country, the higher the level of public corruption. Although a positive relationship between the two does not come as a surprise, the statistical strength of the relationship is overwhelming.

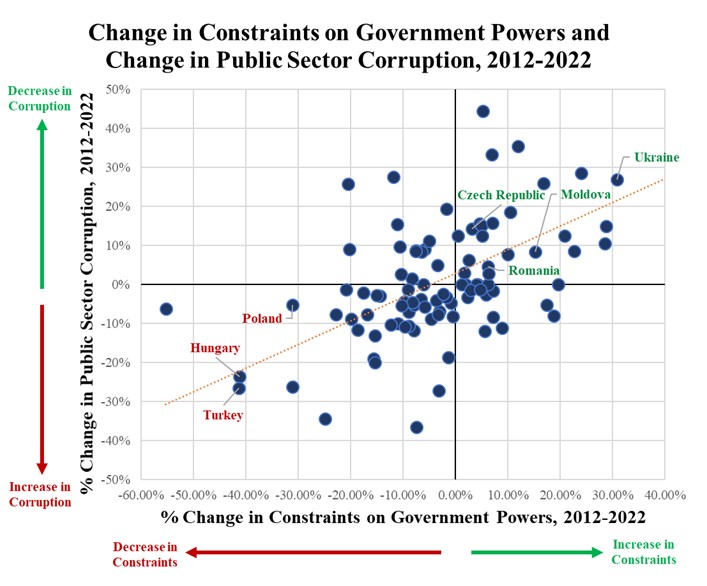

But is this relationship causal? The next figure takes the analysis one step further, by plotting the changes in the two variables over the last decade instead of levels, and finds a similar relationship. On average, in countries that introduced more constraints on government power corruption fell, while in countries that removed checks and balances corruption in the public sector rose. Those striking results are a clear warning sign for Israel’s legislators.

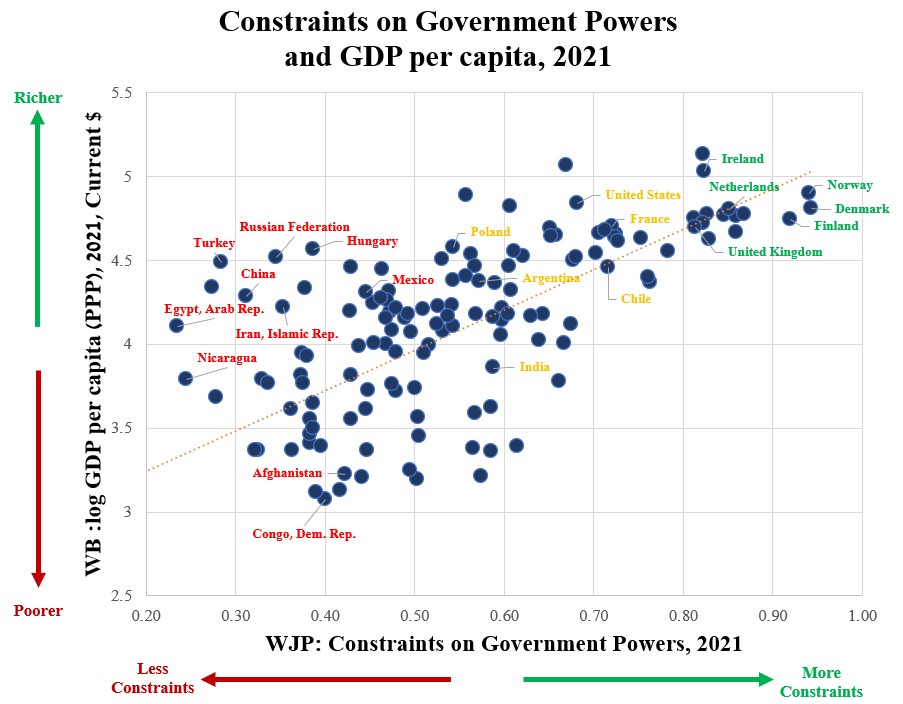

Figure 4

How is all of this connected to the economy? It seems obvious that in itself, government corruption is bad for the economy. But is there more to it? Recently, in an open letter that we are two of its authors, the vast majority of Israeli’s academic faculty in economics and management warned against the “unprecedented damage to the Israeli economy” that will be caused due to “the legal and public service reforms proposed by the Israeli government, which are expected to undermine the independence of the judicial system and the public service.” One of the main arguments in the open letter focuses on the long-term damage to Israel’s growth trajectory. This argument is based on extensive research literature that was carried out in economics starting with the second half of the twentieth century, and over the last 25 years in particular, which emphasizes the important role of “good” institutions-- those with effective constraints on the government, universal legislation, a professional, reliable and independent bureaucracy, and an independent judiciary that can enforce contracts and provides legal protection individuals and businesses, in facilitating long-run economic growth.

Over the past twenty years, economic research using advanced empirical methodologies provided ample evidence supporting the statement that “good” institutions are a leading cause of economic growth. The simple figure below also demonstrates well this relationship. Using a large sample of countries, the figure documents a strong empirical relationship between the extent of constraints on government power and the standard of living in a given country. To produce this graph, we used the World Justice Project data on constraints on government powers in 2021, together with the World Bank data on Gross Domestic Product (GDP) per capita in dollars, standardized for Purchasing Power Parity (PPP). The figure clearly shows that countries with more constraints on the government’s power are richer on average. This is not a new result. In fact, it replicates a well-known result of some of the most prominent scholars in this field of research, Daron Acemoglu, Simon Johnson, and James Robinson, who find a strong positive relationship between limitations placed on the executive branch and its ability to expropriate property and economic development. In other words: Effective judicial review of the government or related mechanisms of checks and balances of governmental power lead to wealth and economic development.

Connecting the Dots

The evidence we presented in this article and a wide literature in economics and related fields of research, highlight the deep concern that the government’s planned constitutional and judicial overhaul, which will remove checks and balances and enable the government to hold too much power, will lead to an increase in corruption and to long-term economic damage. In fact, a draft of OECD’s annual report on Israel’s economy revealed on Thursday (16/2/23) directly addresses the proposed overhaul and expresses the same concerns. According to the report, "The independence of the judiciary and a system of checks and balances are essential for the existence of an honest public system, for trust in the government and public institutions, and for businesses to attract investments and promote a strong economy […] Corruption can divert public resources from productive assets, and is associated with low levels of social spending, including in health and education." Moreover, economic literature shows that “bad” institutions with an unprofessional, uncreditable, and corrupt public sector, are likely to shape cultural norms that continue to impact Israel far into the future, even after those “bad” institutions that created them in the first place will no longer exist.

In light of this, fundamental constitutional and judicial reform such as the ones considered in Israel today should be carried out with extreme caution and a throughout consideration. Otherwise, we and our children might find ourselves living in a corrupt and poor country.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Prof. Itai Ater, leader of the Economists’ Open Letter initiative. Senior Fellow at the Israel Democracy Institute; Coller School of Management, Tel Aviv University

Dr. Tzachi Raz, one of the Economists’ Open Letter authors. Bogen Family Department of Economics and the PPE program, Hebrew University