Survey of the Financial Situation of Workers During the Iron Swords War

This survey is the second in series taken since the outbreak of the Iron Swords War assessing the financial impact of the war on the Israeli workforce.

Workers of "Pri Galil" protest against the factory management's decision to lay off workers, in Hatzor HaGlilit. Photo by: David Cohen/Flash90

- 91% of the salaried workers who were in employment when the war broke out are still salaried workers today, while some 5% were dismissed or put on unpaid leave, and around 2% changed their status from salaried to self-employed.

- 87% of workers who were self-employed when the war broke out have the same status today, while around 11% have become salaried employees.

- More than half the self-employed workers have yet to recover financially: 54% experienced a decline of around 50% in their business activity.

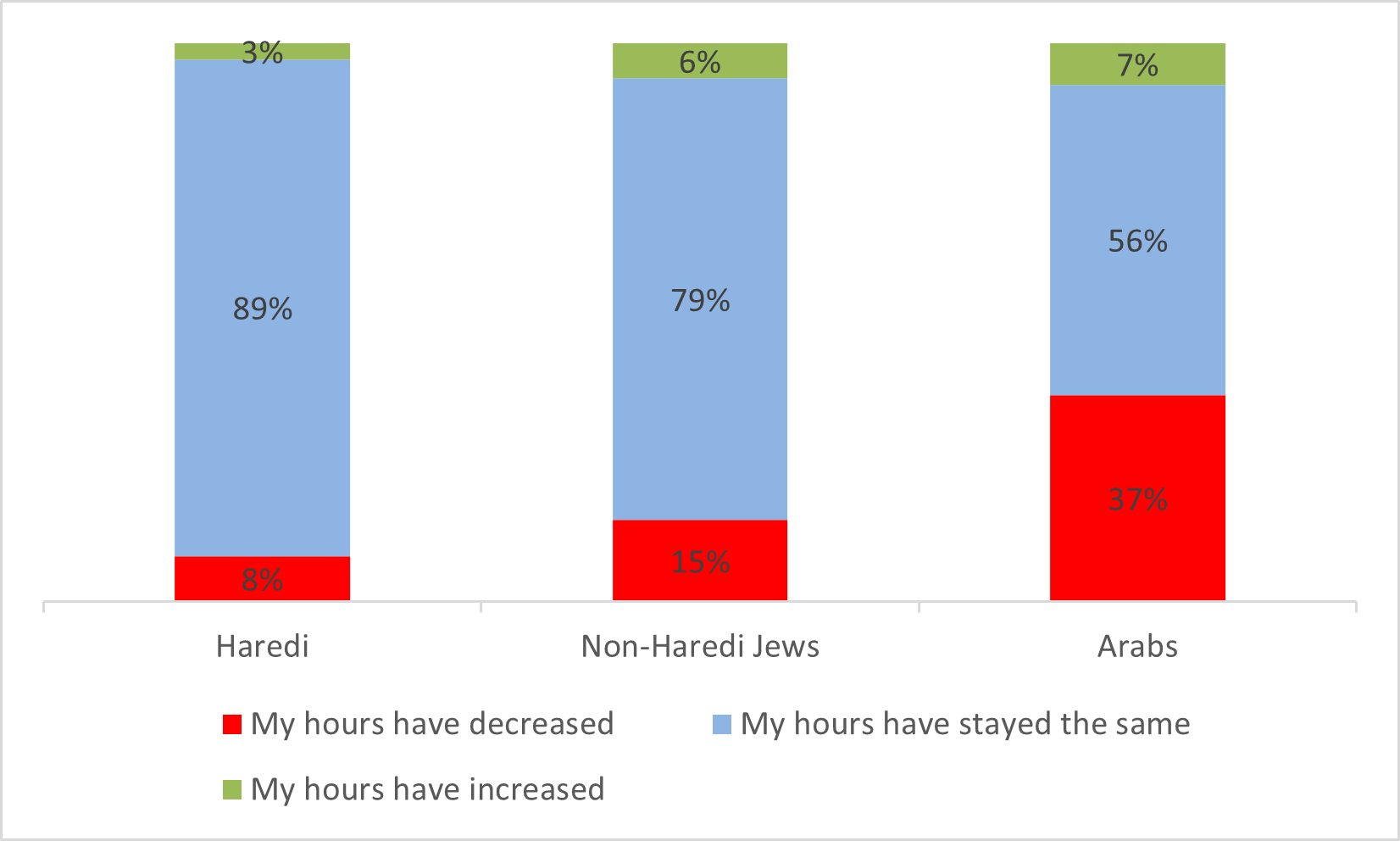

- Among salaried workers, Arab employees were hit hardest: 37% reported a reduction in their working hours, compared to 8% of Haredim and 15% of non-Haredi Jews.

- The extent of the reduction in working hours (52%) was also significantly greater among Arab salaried workers.

- Younger workers have experienced a greater reduction in working hours than older workers.

- The share of those whose working hours have been reduced is largest in the youngest age group (20–24), at 40%, compared to all other age groups.

- 36% of respondents reported that their household income is lower now than before the war.

- The share of those with a lower household income than before the war stands at 58% among self-employed workers, compared to just 31% of salaried workers.

- 55% of Arab respondents reported a decrease in household income compared to 32% among non-Haredi Jews and just 20% among Haredim. This represents a worsening situation among Arab workers relative to the January 2024 survey.

- A relatively large share of respondents who work in the non-profit sector (39%) reported a decline in household income due to the war.

- 28% of respondents say that their households have no liquid funds at all, while just 7% say that the money their household has available would not be enough to last a month.

- By contrast, a year and a quarter since the outbreak of the war, around a half of all respondents think that their household’s available funds would last more than a month—27% say that it would be enough for more than three months, and 23% that it would last between one and three months.

- Particularly high proportions of Haredim (45%) and Arabs (40%) reported that their households have no liquid funds at all, indicating a problem with liquidity in these sectors.

- We found a relatively low level of liquidity among workers who were living in the north and in Haifa on the eve of the war, with particularly large shares reporting that their households have no available funds at all (35% in the north, 37% in Haifa).

- The share of respondents who were unable to provide an estimation of their household liquidity was largest in the north (19%) and in the south (17%), reflecting the high level of uncertainty among households in these regions.

- Some 30% of respondents have taken out an overdraft or increased their overdraft since the war began.

- 52% of Arab respondents have taken out an overdraft or increased their overdraft due to the war, compared to around a quarter of Jewish respondents.

- Relative to the survey conducted in January 2024, there has been a rise in the number of households that have been forced to take out a loan or access their savings.

In conclusion, the survey highlights several populations that require special attention: Arab salaried workers, self-employed workers, workers in the non-profit sector, young adults, and residents of Israel’s south and north. We plan to undertake a special analysis of the population of evacuees.

This survey is the second in a series carried out since the outbreak of the Iron Swords War.

The survey was conducted using a representative sample of the population of workers in Israel (both salaried and self-employed) who were in employment as of October 6, 2023, just before the war began. There were a total of 1,236 respondents to the survey, of whom 1,028 were salaried employees before the war and 208 were self-employed. The maximum sampling error is ±2.79% at a confidence level of 95%.

Questionnaire design and survey analysis was carried out by the research staff of the Center for Governance and the Economy, with advice and support provided by the Viterbi Family Center for Public Opinion and Policy Research at the Israel Democracy Institute. Data collection was performed by CI Marketing Information between December 15, 2024 and January 5, 2025, some 15 months after the beginning of the Iron Swords War, with 992 men and women interviewed in Hebrew and 244 in Arabic. Interviews were conducted via the internet and by telephone.

We should note that the period during which the survey was carried out, from mid-December 2024 to early January 2025, came after the ceasefire agreement with Lebanon but before the current deal for the release of the hostages in Gaza, which also includes commitments to end the war. It is reasonable to assume that these developments would have influenced the interviewees’ general outlook and level of optimism, particularly regarding questions looking toward the future.

The Financial Situation of Workers in Israel - 15 Months After October 7

- The Employment Status of Salaried and Self-Employed Workers Who Were in Employment Immediately Before the War

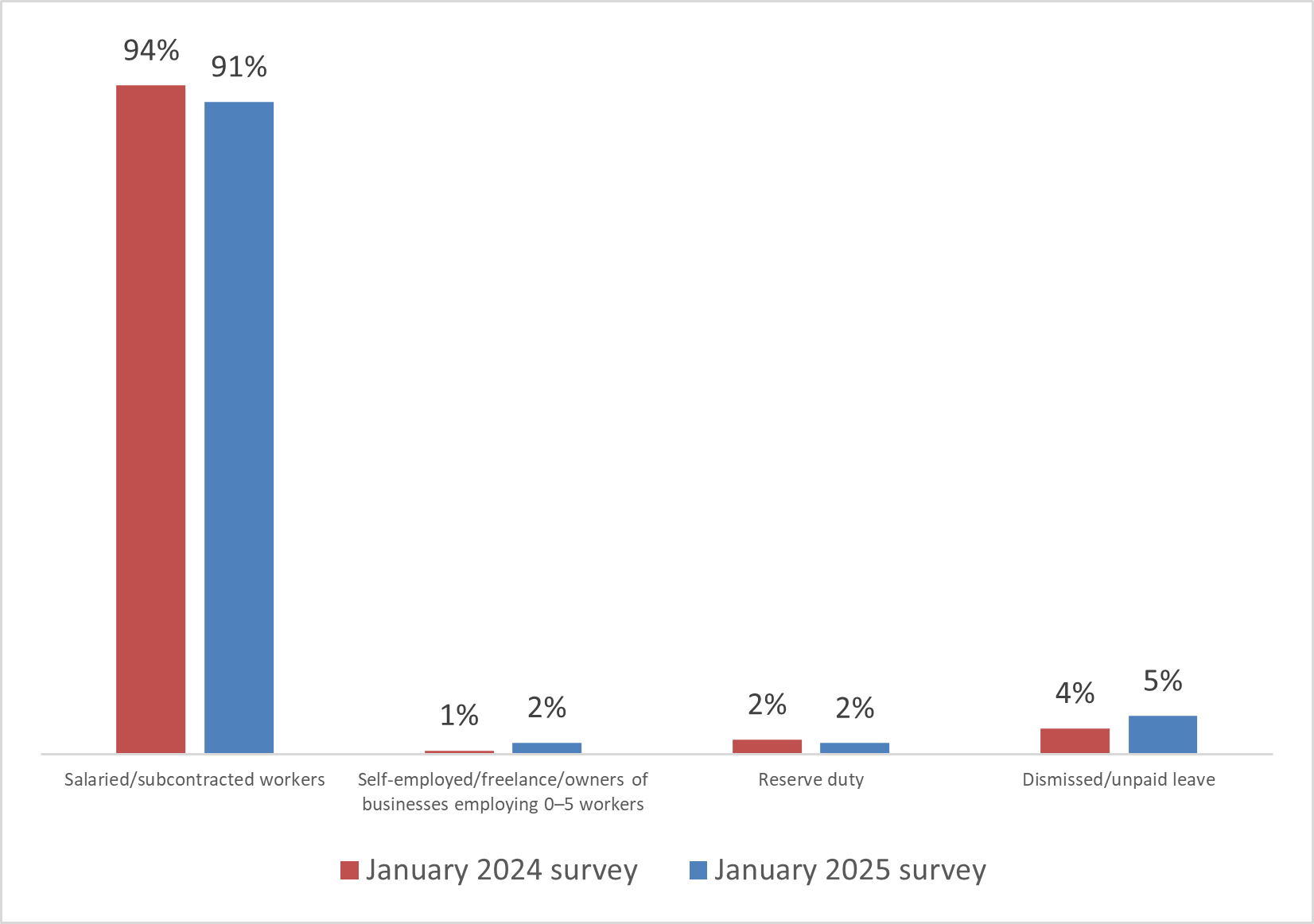

The majority of salaried employees (around 91%) who were working on the eve of the Iron Swords War are still in salaried jobs today, at the time of the survey (December 2024 to January 2025). Around 5% have been dismissed or put on non-paid leave, around 2% are in reserve duty, and around 2% have changed their status to self-employed.[1]

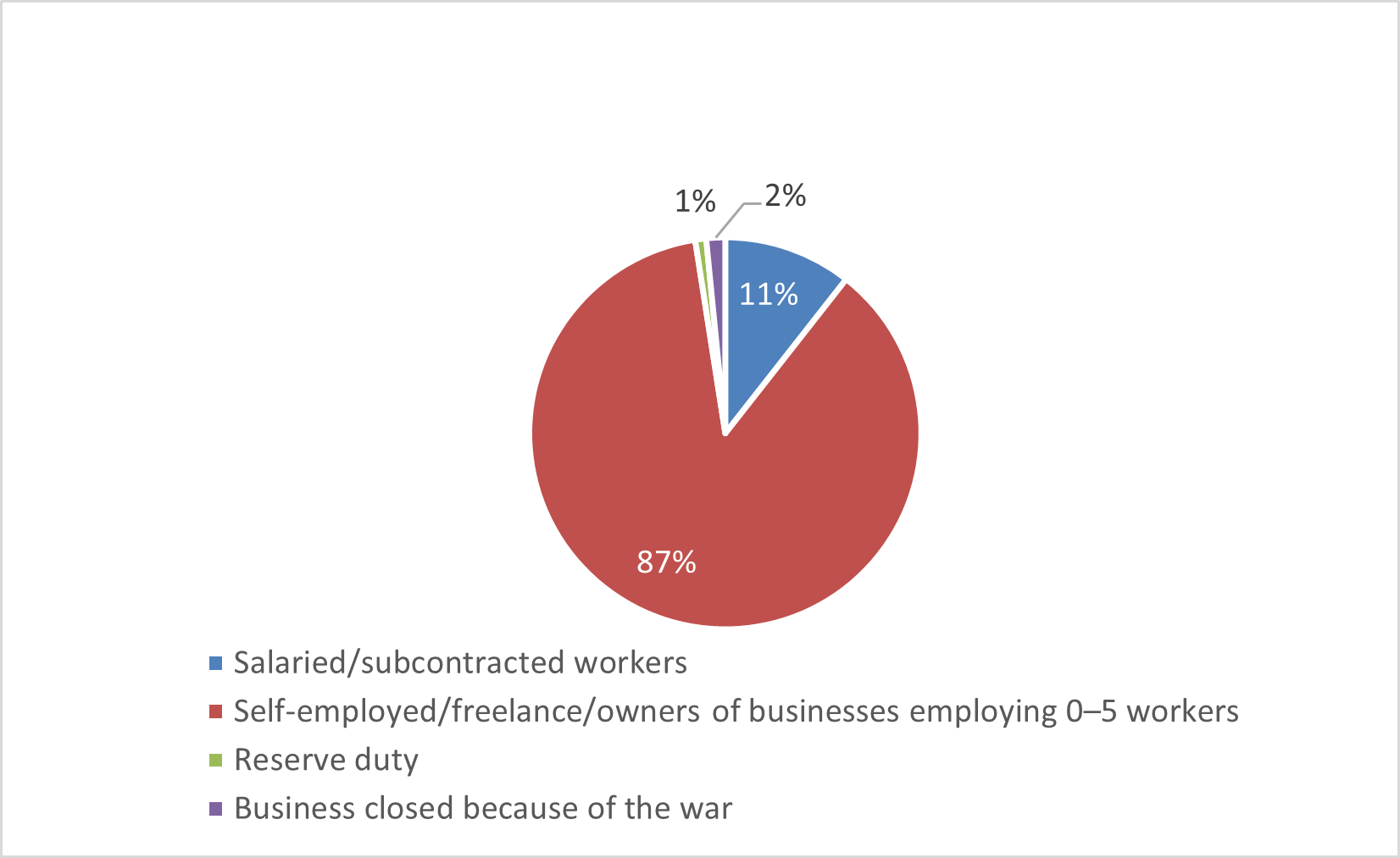

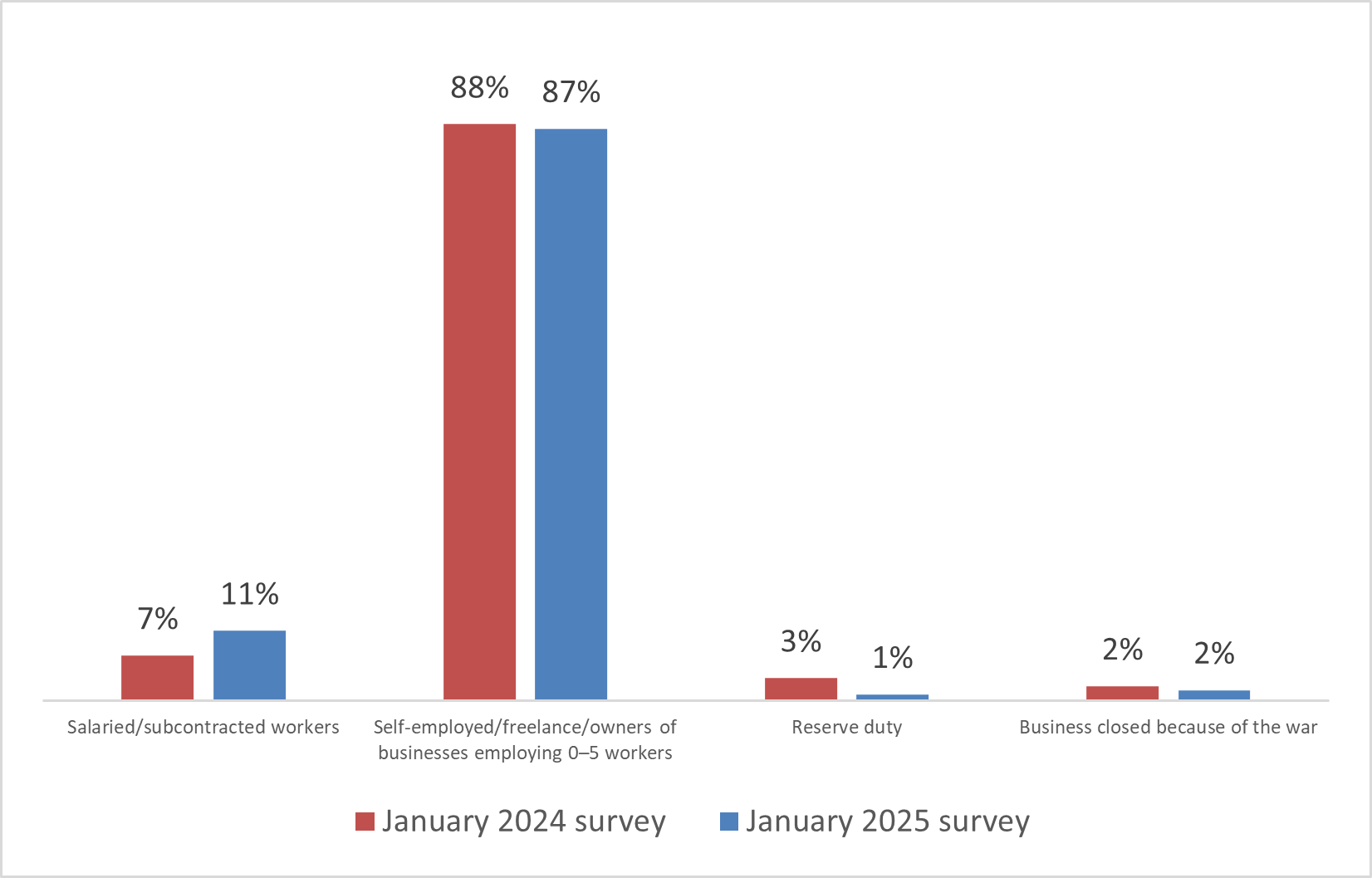

A similar picture emerges regarding self-employed workers, with the large majority of those who were self-employed before the war (87%) still self-employed now, while around 11% have changed their status to salaried, and around 1% reported that their business has closed down.

Relative to the previous survey in January 2024, then, the employment status of the vast majority of respondents has remained the same.

Figure 1. Current employment status of those who were working immediately before the war, January 2025 survey

Were salaried workers before the war

Were self-employed before the war

Figure 2. Current employment status of those who were working immediately before the war, January 2024 and January 2025

Were salaried workers before the war

Were self-employed before the war

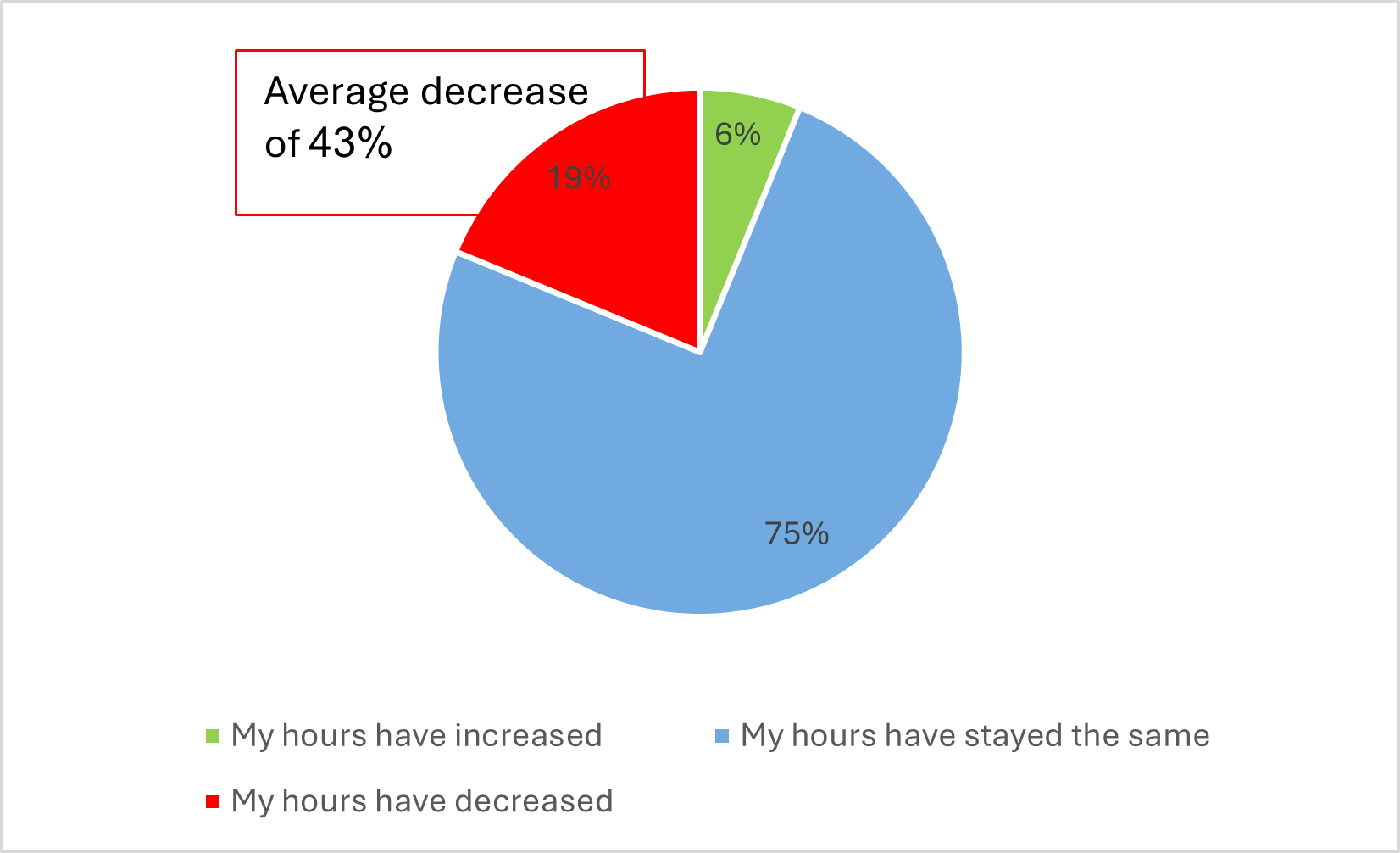

The survey found that the war has had a more severe effect on self-employed workers than on salaried employees:[2] 54% of self-employed workers reported that the scale of their business activity has declined because of the war, compared to just 19% of salaried workers who reported a decrease in work hours. Among salaried employees, 75% say that they remain employed at the same level of work hours as before the war, as contrasted with just 38% of self-employed workers who reported that the scale of their business activity has not been affected by the war. Only 6% of salaried workers have experienced an increase in their number of work hours relative to before the war, as have 8% of self-employed workers.

Regarding the extent of the decrease in the number of work hours and in business activity, the salaried workers who have been affected reported a fall of around 43% in their work hours, while the affected self-employed workers reported a decline of 50% in the scale of their business activity due to the war.

The fact that today, around 15 months after the outbreak of the war, 54% of self-employed workers are reporting a fall in their business activity, and put the scale of this drop at around 50%, demonstrates that more than half of Israel’s self-employed have yet to recover from the impact of the war on their business activity and on their income.

Figure 3. Impact of the war on work hours of those in work before the war

Salaried workers

Self-employed workers

The survey found that the greatest impact on work hours among salaried workers was experienced by Arabs: 37% of Arab salaried workers reported a reduction of their work hours, compared to 8% of Haredim and 15% of non-Haredi Jews. The extent of the decrease in work hours was also greater among Arab salaried workers, at an average of 52%—compared to an average reduction of 37% among non-Haredi Jewish salaried workers, and 31% among Haredi salaried workers.

The sizable impact of the war on the work hours of Arab salaried workers requires special attention. It would be worth examining in detail the reasons for this, and looking at whether employers are more fearful of employing Arab workers in the wake of the events of October 7, or whether there has been pressure from Jewish workers to reduce the scale of employment of Arabs, or other possible reasons. It is very important to maintain the integration of the Arab population in the Israeli labor market, and thus this phenomenon requires in-depth study.

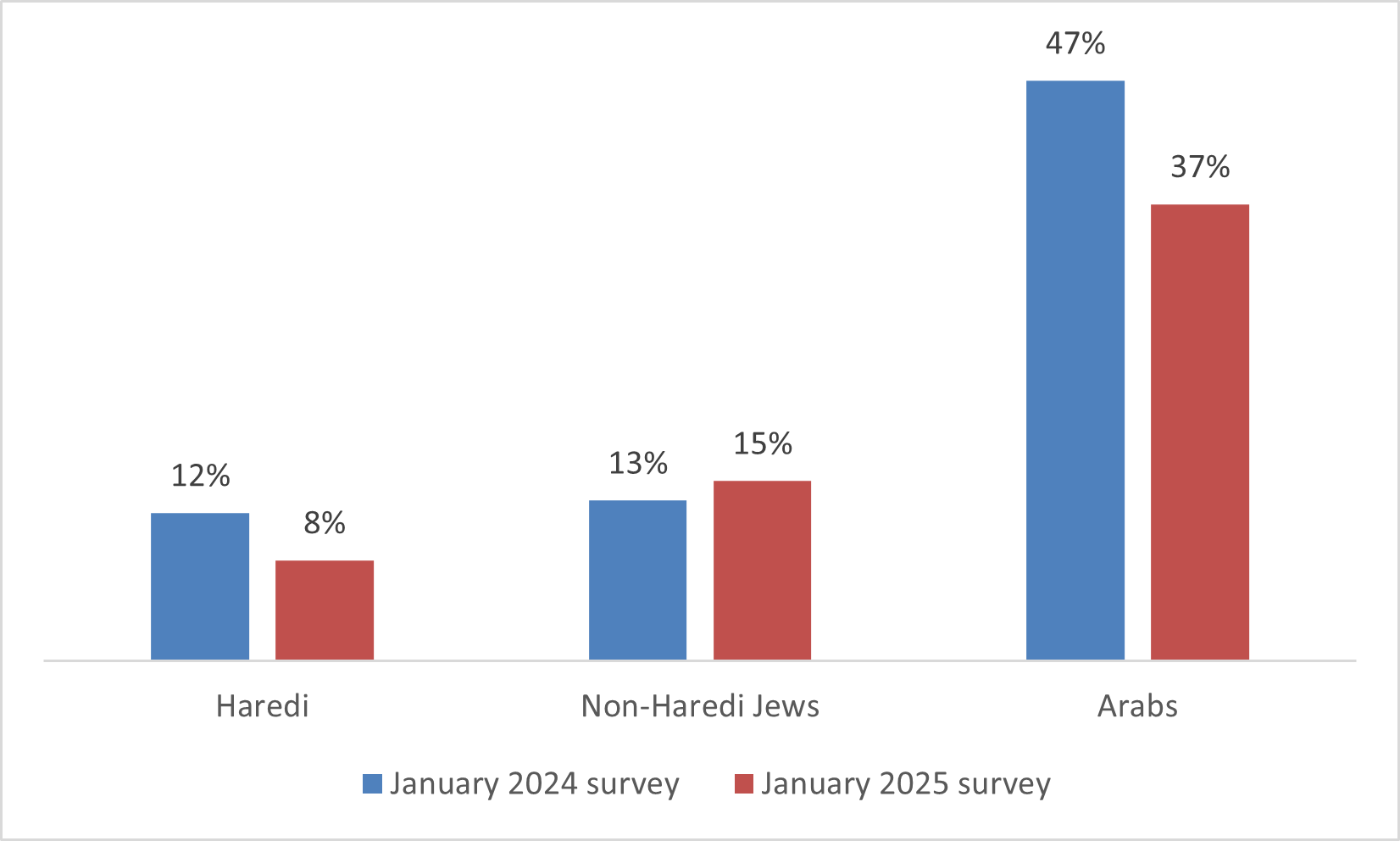

Relative to the January 2024 survey, held just a few months after the war broke out, the situation of Arabs and Haredi Jews would seem to be less harsh today: The share of Arabs who report a decrease in their work hours is now 37%, compared to 47% in January 2024, while the share of Haredim reporting a decrease in work hours is now 8%, compared to 12% a year ago.

Figure 4. Impact of the war on weekly hours of salaried employees who were in work before the war, by population group

Figure 5. Share of salaried workers whose hours were reduced due to the war, by population group, January 2024 and January 2025

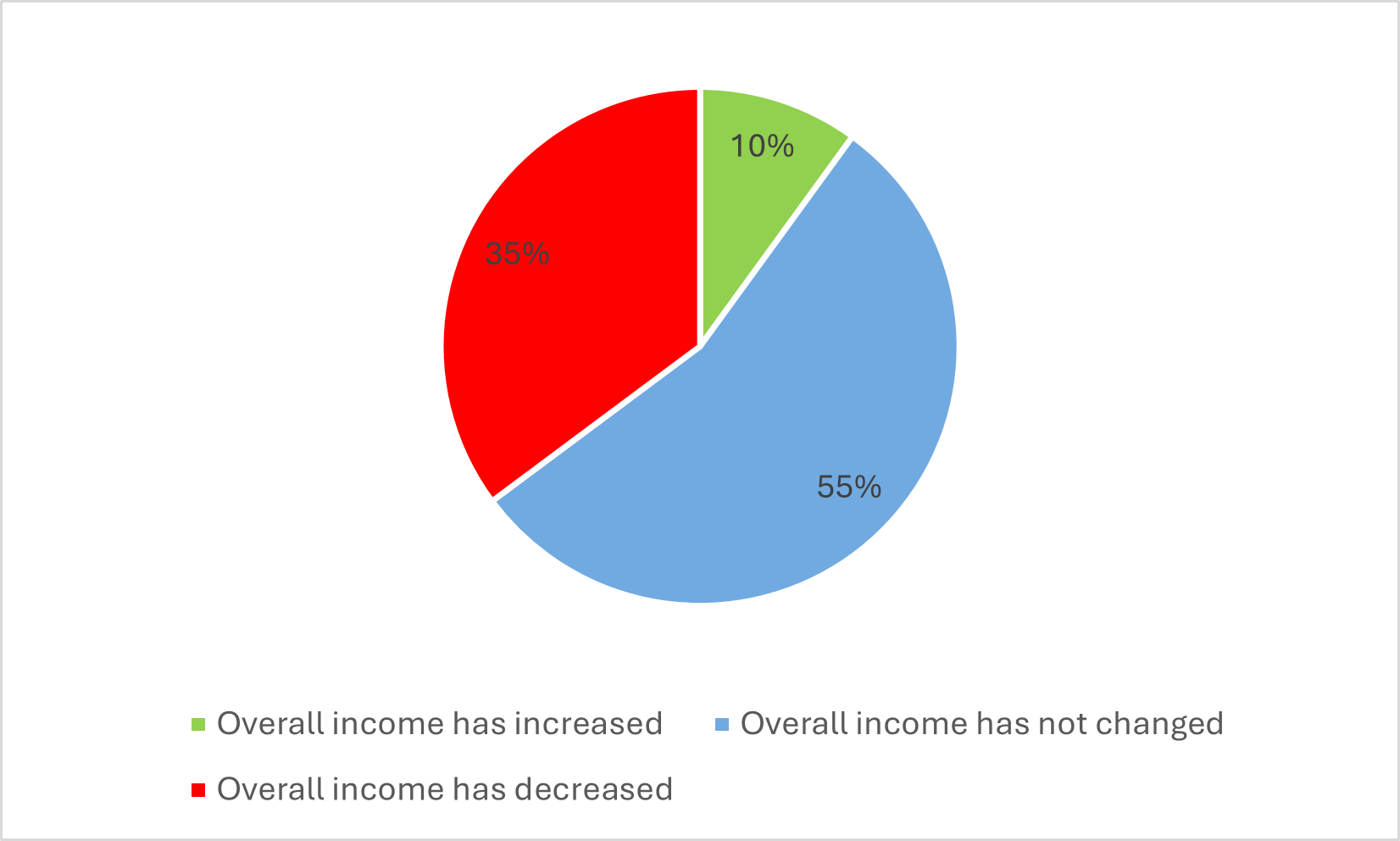

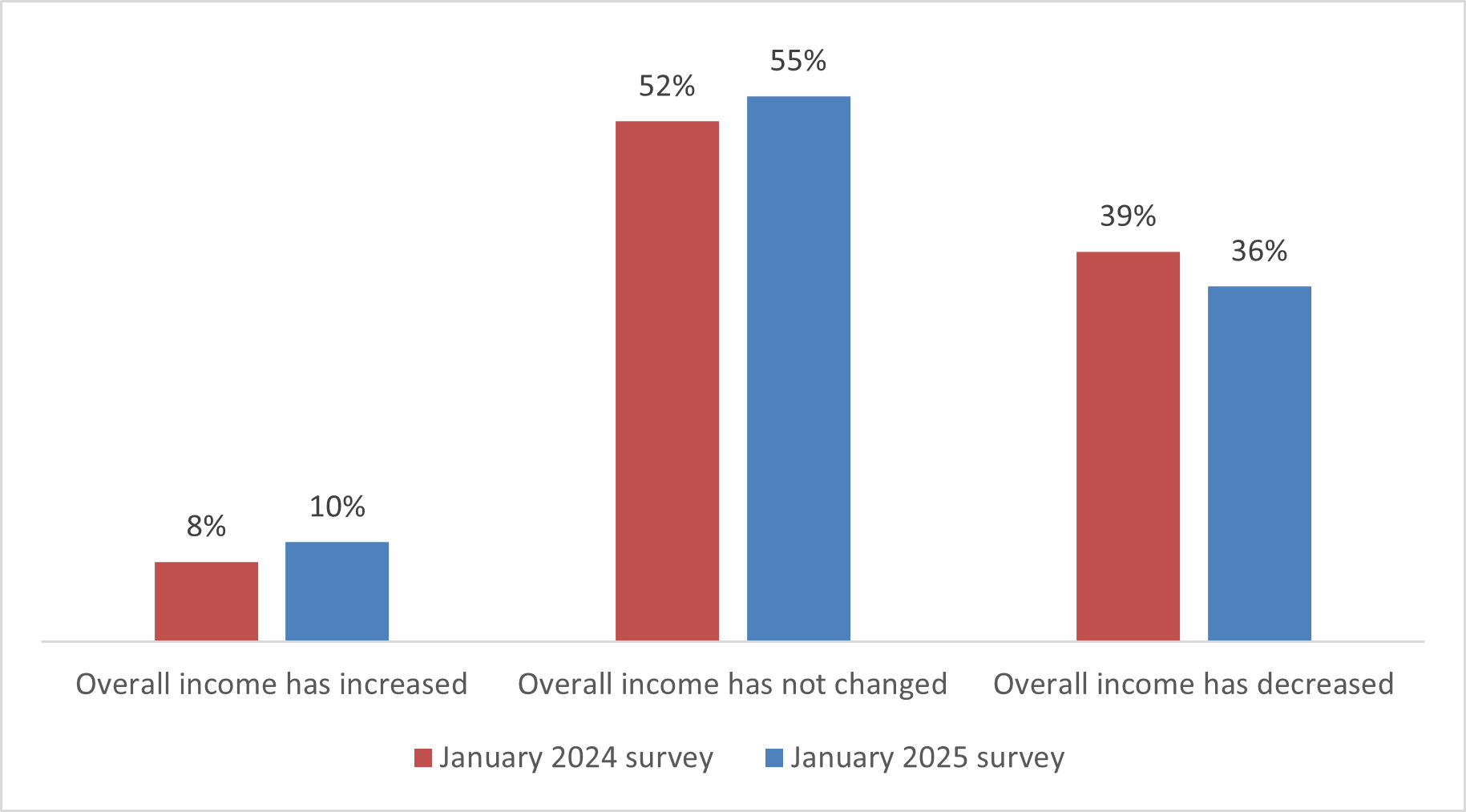

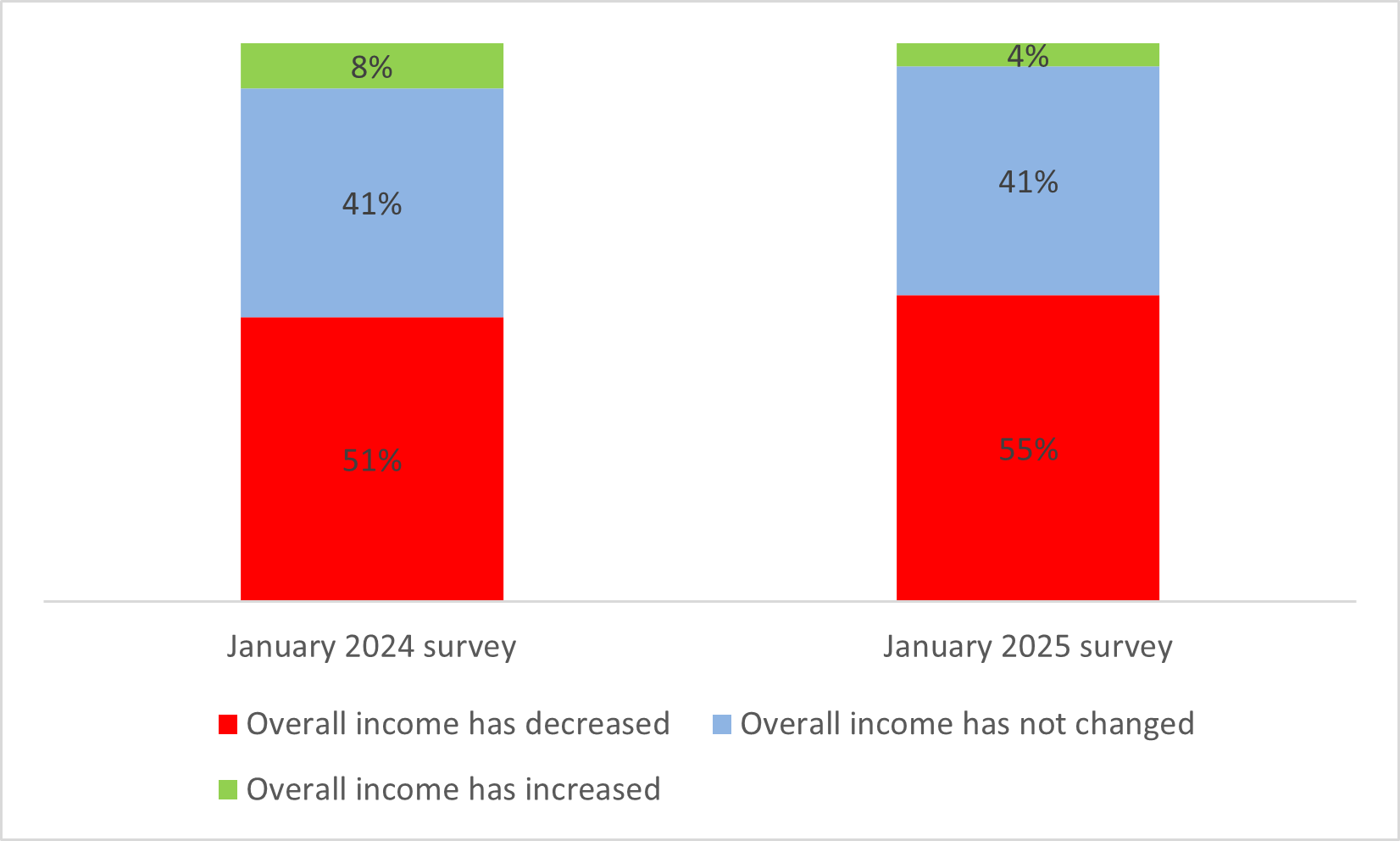

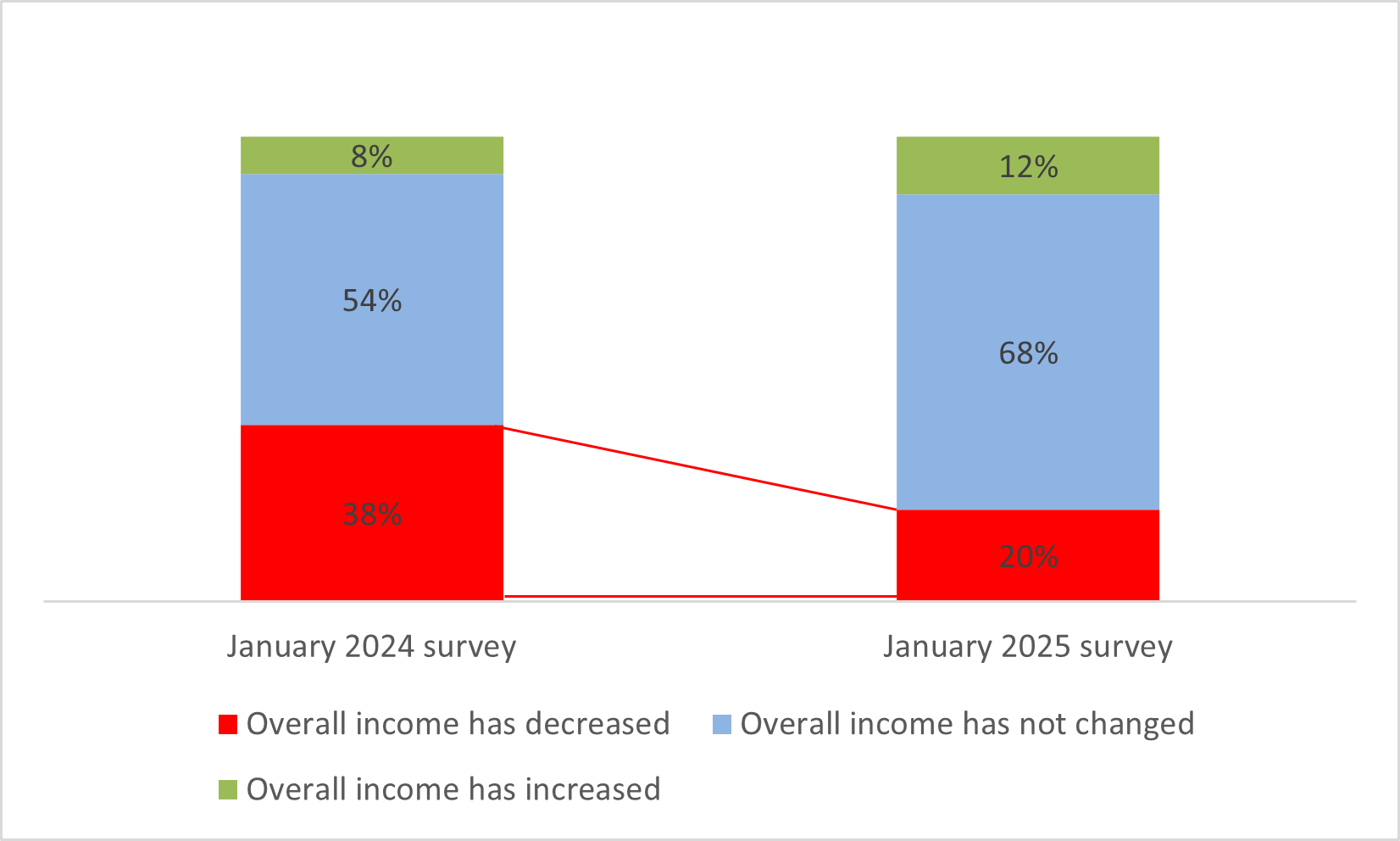

Some 36% of respondents reported that their household income, as of the time they participated in the survey,[3] was lower than during the period before the war. A similar share (39%) said the same in the January 2024 survey. This indicates that the large majority of households that suffered a drop in income due to the war have still not been able to return to their pre-war situation, some 15 months later.

As in last year’s survey, just over half the respondents (55%) say that their household income has remained unchanged, while around 10% reported an increase in income relative to before the war.

Figure 6. Change in household income of workers (salaried and self-employed) relative to pre-war levels

Figure 7. Change in household income of workers[4] relative to pre-war levels, January 2024 and January 2025

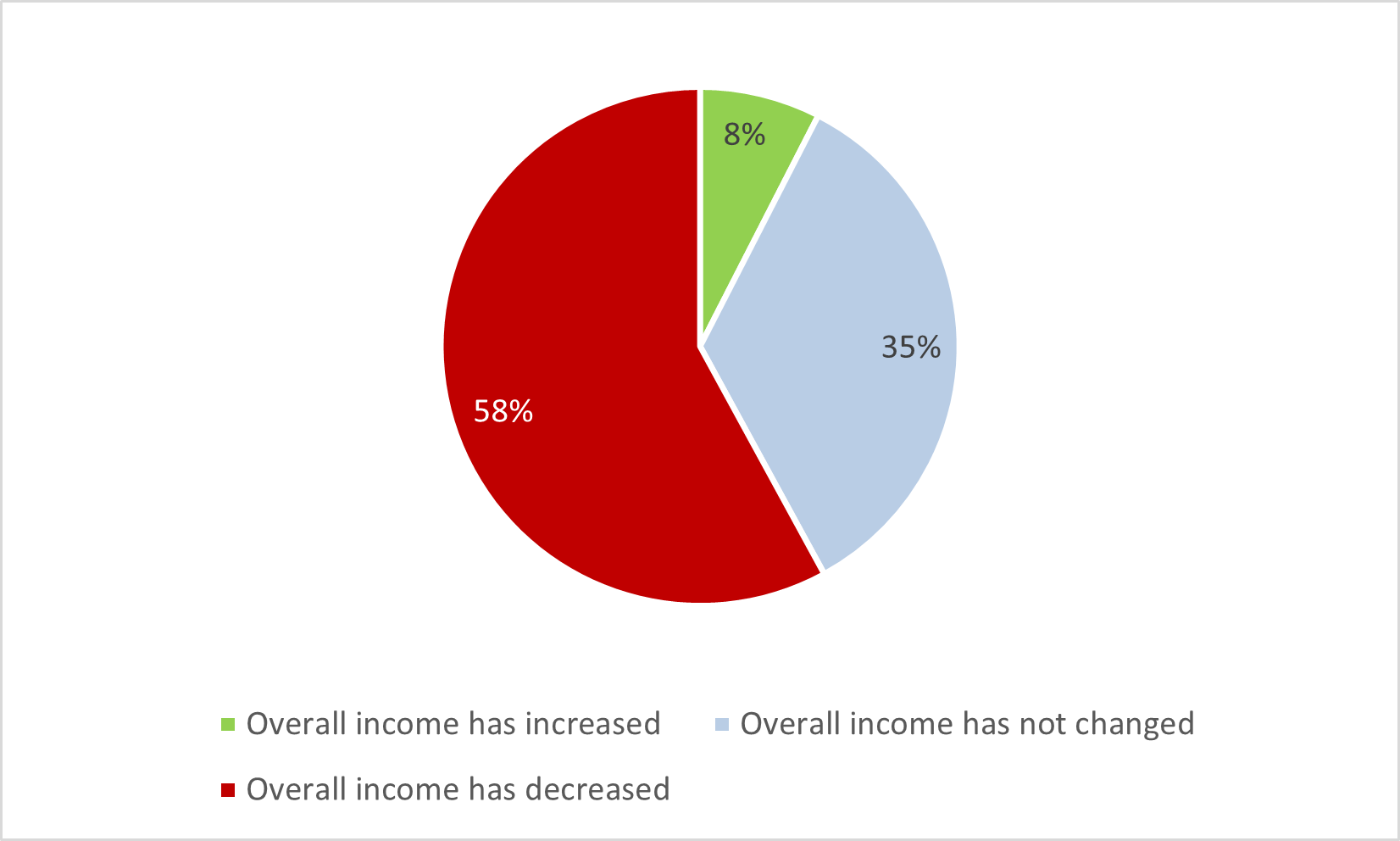

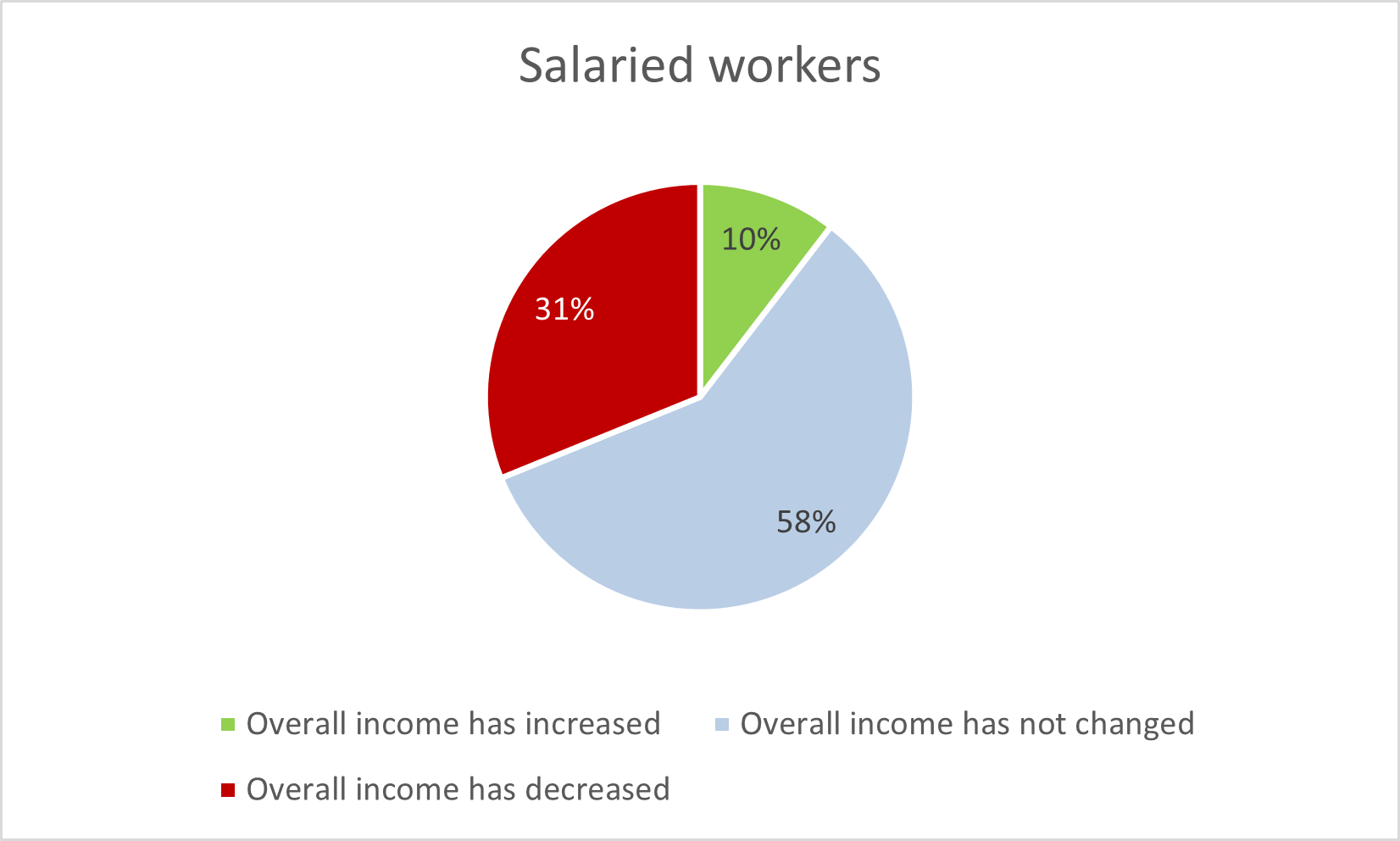

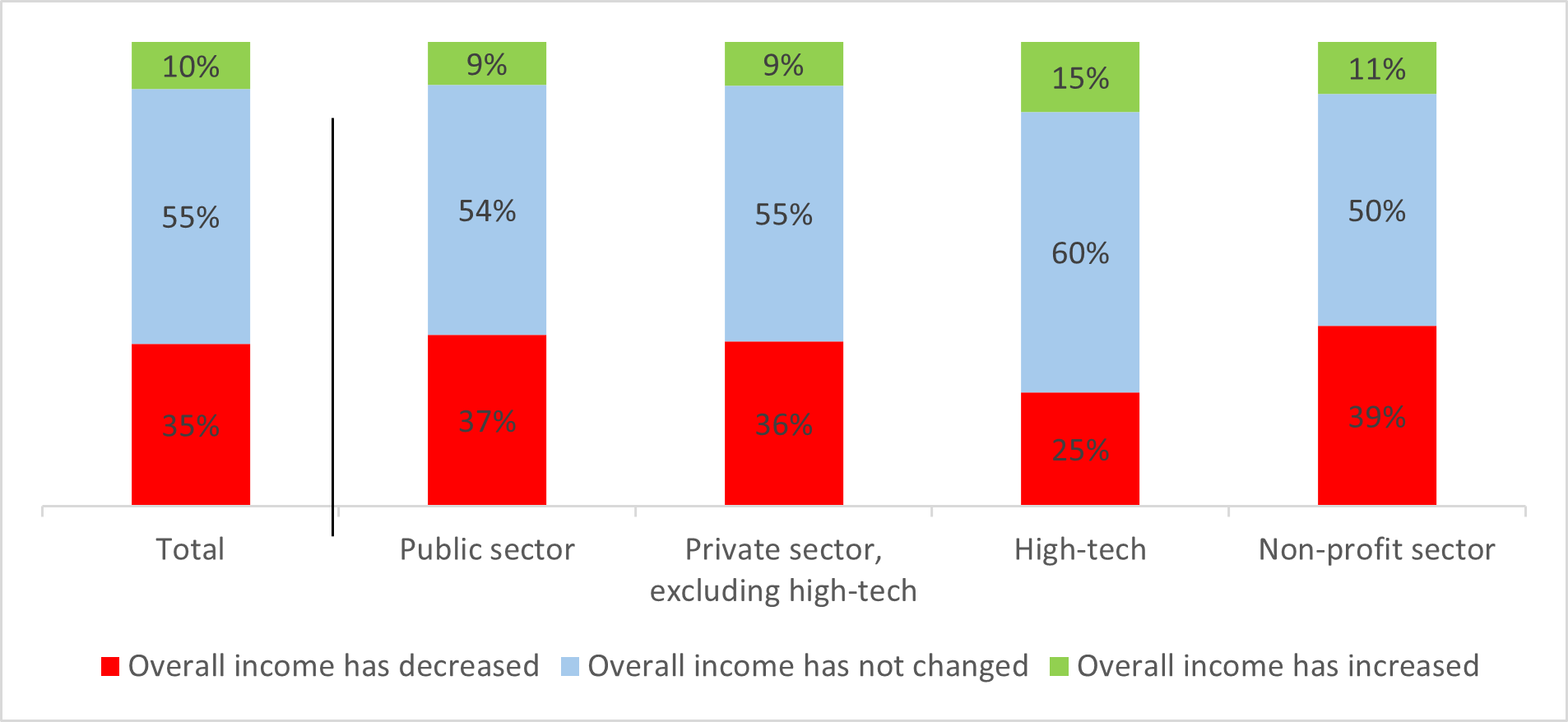

The survey reveals the large difference between the situations of self-employed and salaried workers, over a year after the outbreak of war. While the majority of self-employed respondents (58%) reported that their household income[5] was lower than before the war, only 31% of salaried workers said the same.

In contrast to self-employed workers, the majority of salaried workers (58%) said that there has been no change in their household income relative to before the war, compared to just 35% of self-employed workers.

The share of respondents who reported an increase in household income remains low in both groups: 10% among salaried workers, and 8% among self-employed workers.

Figure 8. Change in household income of workers relative to pre-war levels, self-employed and salaried

Self-employed workers

Salaried workers

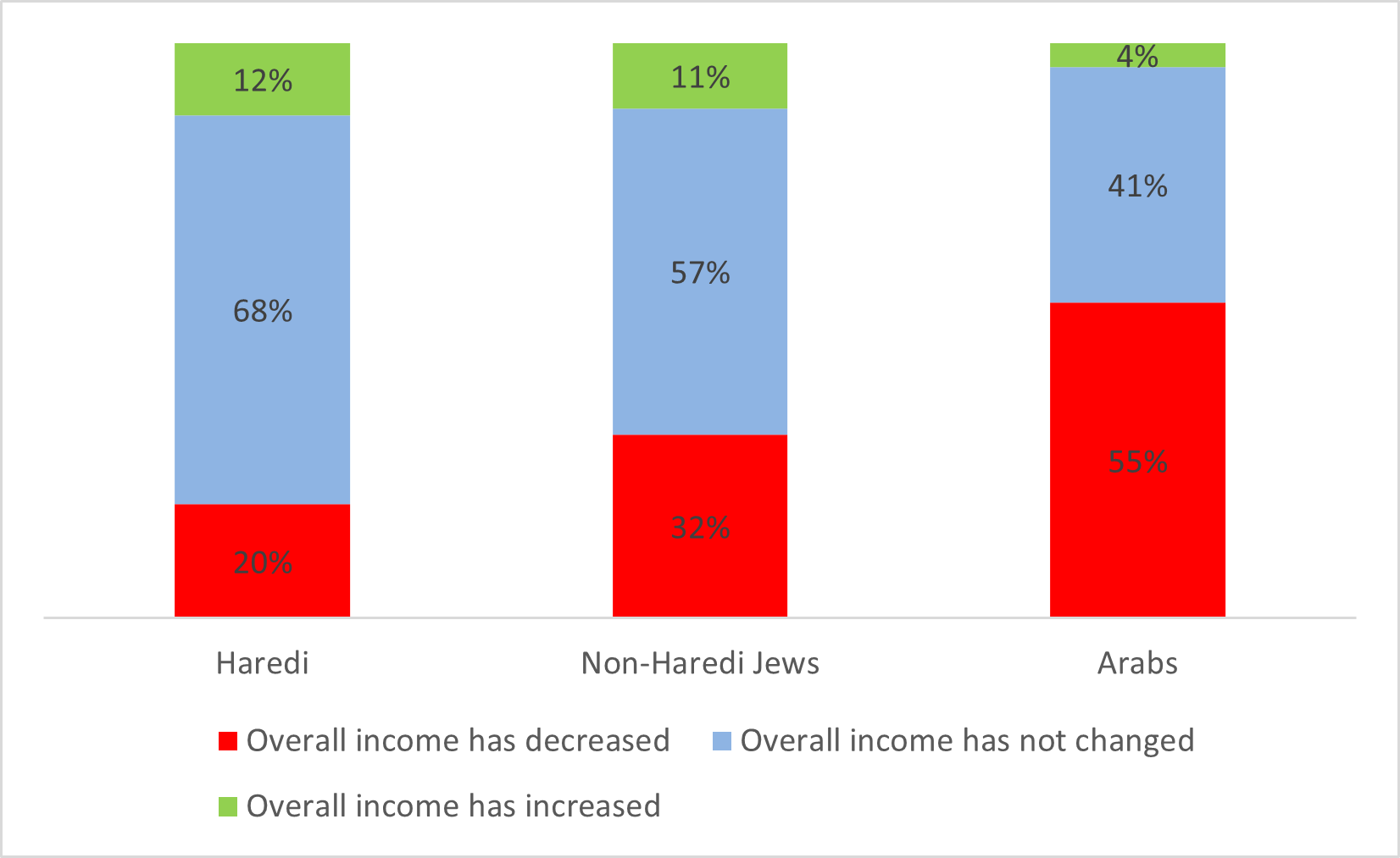

A significant proportion of Arabs (55%) reported a decline in their household income relative to pre-war levels, compared to 32% of non-Haredi Jews and 20% of Haredim. In fact, the majority of Haredim (68%) and of non-Haredi Jews (57%) say that there has been no change in their household income relative to before the war, and around 11% reported an increase in income. By contrast, only 41% of Arab respondents have experienced no change in their household income, while just 4% reported an increase.

Thus, while 80% of Haredi respondents and 68% of non-Haredi Jewish respondents reported having had no reduction in their household income, less than half of Arab respondents (45%) could say the same.

Figure 9. Change in household income of workers relative to pre-war levels, by population group

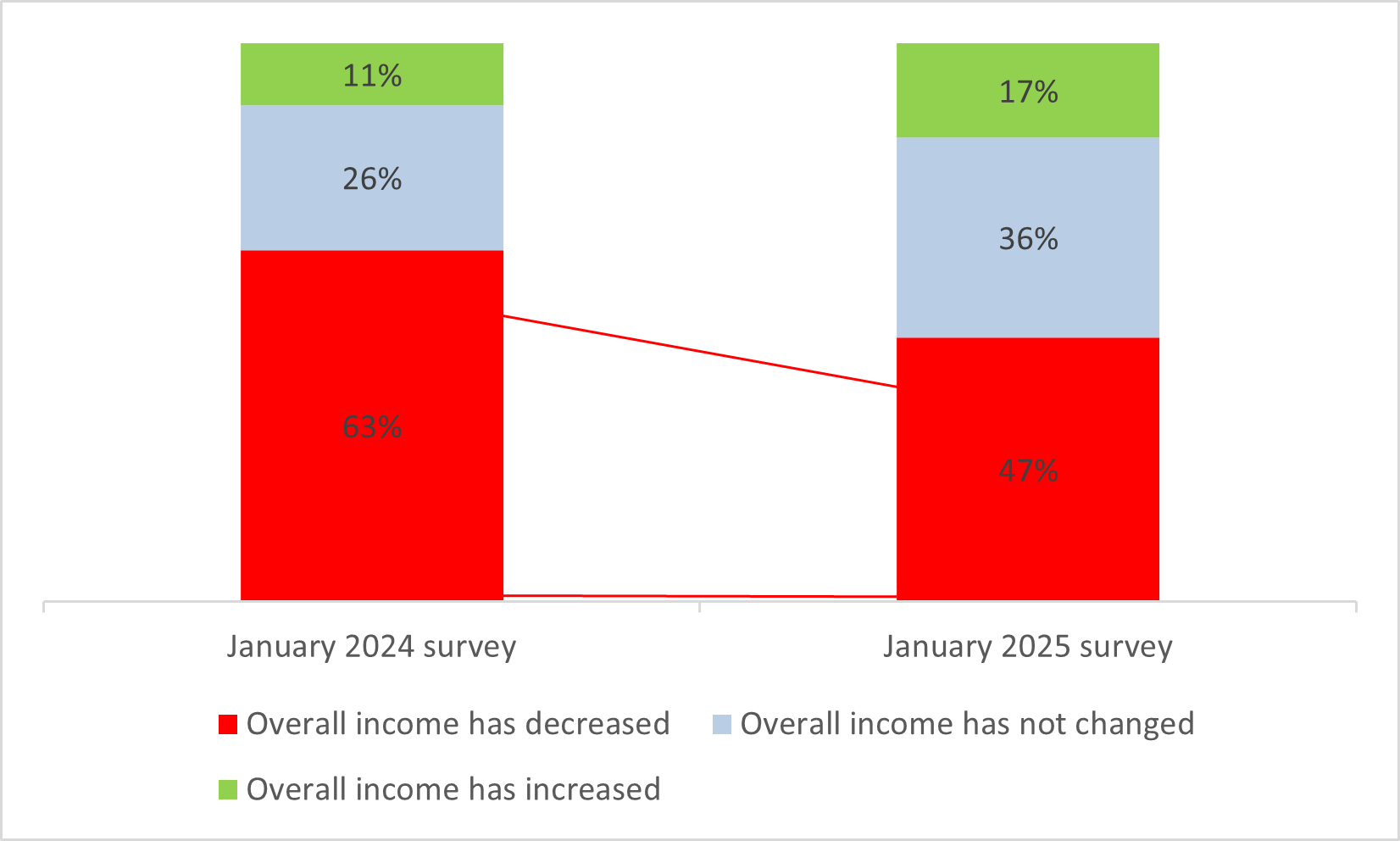

Relative to the January 2024 survey, conducted just a few months after the war began, there has been an improvement in the financial situation of Haredi households, with the share of those reporting a fall in household income relative to pre-war levels having declined from 38% in January 2024 to 20% in January 2025.

By contrast, the situation of Arab households has worsened, with the share of respondents reporting a fall in household income relative to pre-war levels having risen from 51% in January 2024 to 55% in January 2025.

Figure 10. Change in household income of workers relative to pre-war levels, Arabs and Haredi Jews, January 2024 and January 2025

Arabs

Haredim

A relatively large share of respondents who work in the non-profit sector (39%) reported a decline in household income due to the war. This finding demands special attention, given that civil society organizations played a significant role in aiding the population groups immediately affected by the events of October 7, as well as the evacuees from the north and the south.

By contrast, a relatively small proportion of high-tech workers reported a fall in household income, while a relatively large share (15%) reported an increase in household income. These findings highlight the differential impact of the war on different populations and market sectors, and raise concerns that the war has widened the gaps between echelons of Israeli society.

Figure 11. Change in household income of workers relative to pre-war levels, by sector

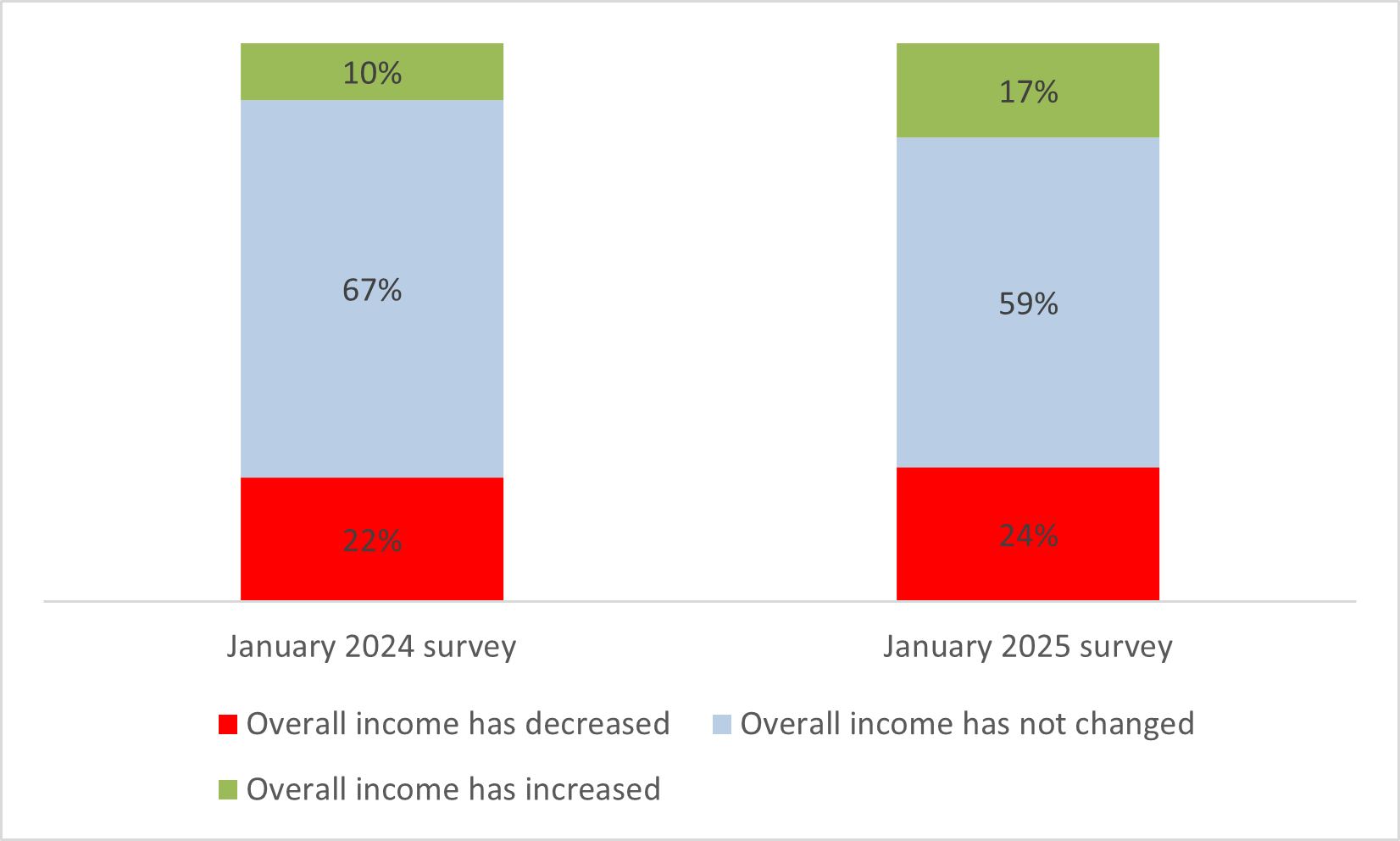

Relative to the January 2024 survey, there has been an improvement in certain employment sectors in terms of the proportion of workers reporting an increase in household income, such as in medical and paramedical occupations and in high-tech (from 10% in the January 2024 survey to 17% in the current survey).

There has also been a significant recovery in occupations in leisure, tourism, culture, and the arts, with a decline in the share of workers reporting a fall in household income, from 63% in January 2024 to 47% in January 2025. At the same time, this proportion remains much higher than the equivalent share of workers in other market sectors.

Figure 12. Change in household income of workers relative to pre-war levels, by occupation

Occupations in leisure, tourism, culture, and the arts

Occupations in high-tech

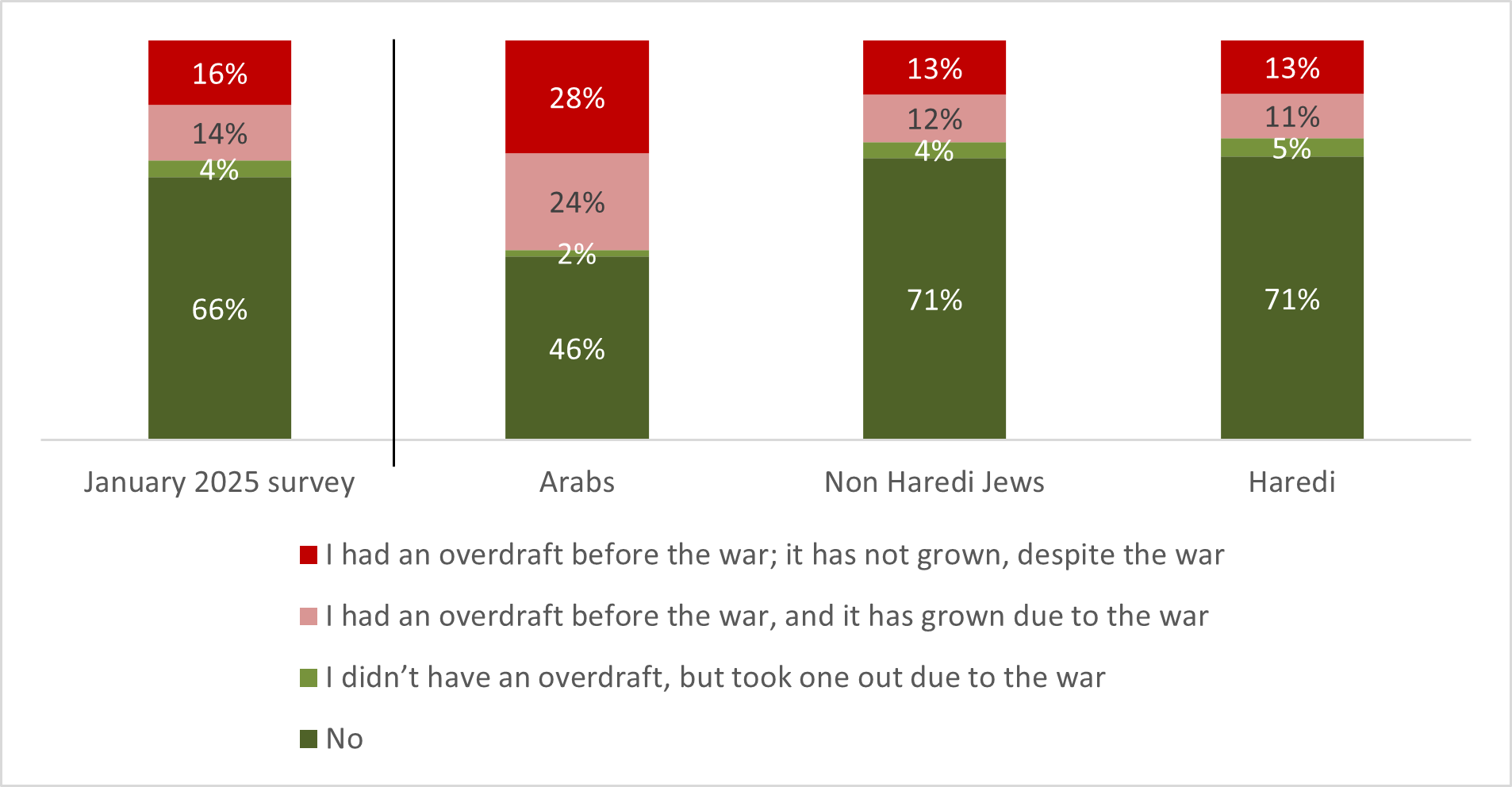

Some two-thirds of respondents to the January 2025 survey (67%) reported that they have not taken out an overdraft due to the war, while 4% had an overdraft before the war but have not increased it since. By contrast, around 30% of respondents said that they have taken out an overdraft (16%) or increased their overdraft (14%) as a result of the war. The impact of the war on household overdrafts has remained relatively stable, with no significant changes compared to the January 2024 survey.

Figure 13. Has the crisis caused your household to take out or increase an overdraft? January 2024 and January 2025

The current survey reveals sizable discrepancies between population groups regarding overdrafts. More than half (52%) of the Arab population have taken out or increased an overdraft because of the war, compared to around a quarter of the Jewish population. In particular, 28% of Arab respondents said that they had an overdraft before the war but have increased it subsequently, more than double the equivalent share among Jews. In addition, only 46% of Arabs do not have an overdraft, compared to 71% of Jews. The data indicate that the impact of the financial crisis following the war has been most severe for the Arab population, with a large proportion of households having taken out or increased an overdraft.

Figure 14. Has the crisis caused your household to take out or increase an overdraft? By population group

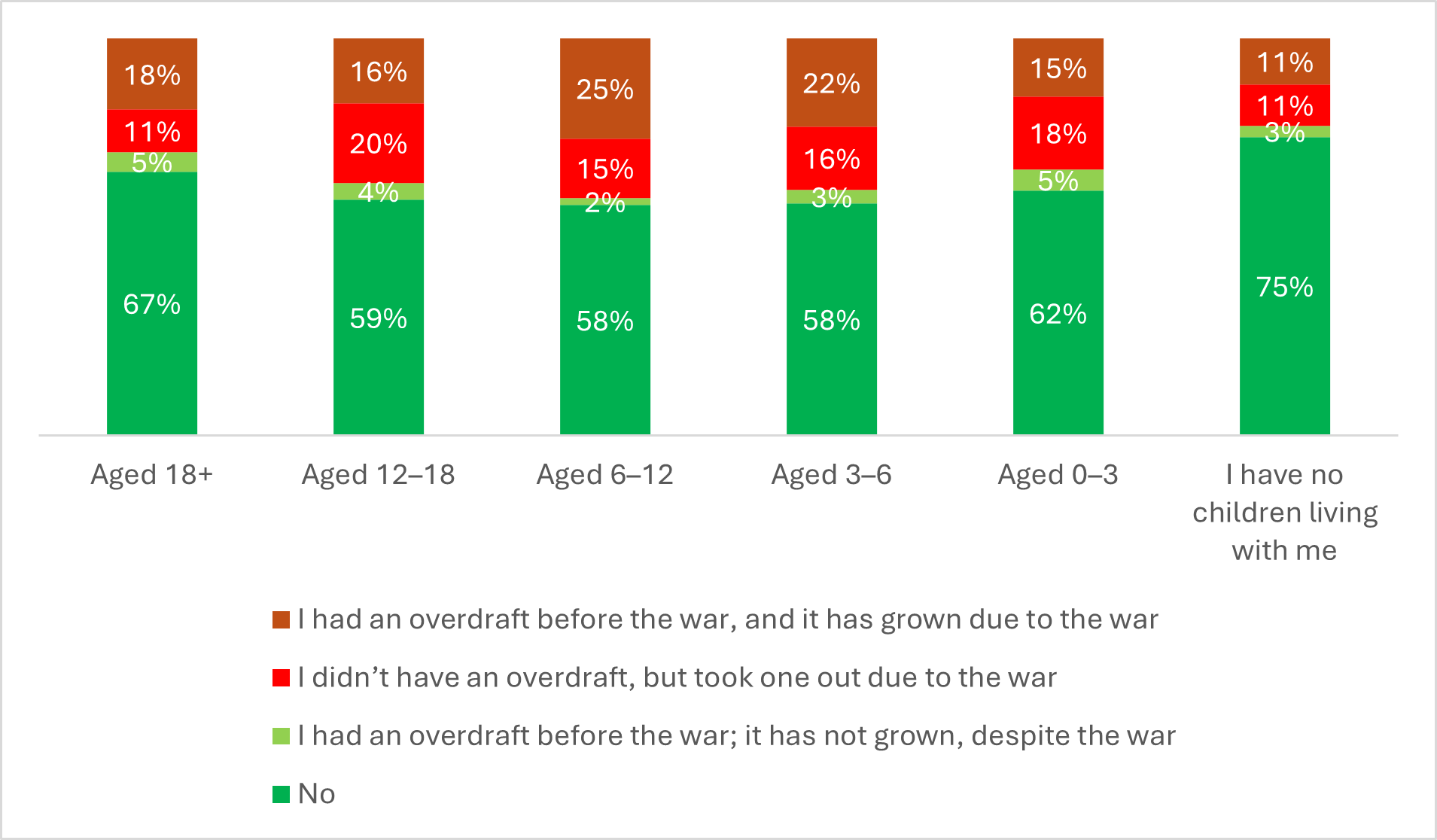

Around 22% of households without children have taken out an overdraft or increased an existing overdraft because of the war, as have around 29% of households with children aged 18 and above. By contrast, 33% of households with small children (aged 0–3), and 38%–40% of households with children aged 3–12, have taken out or increased an overdraft as a result of the war.

Figure 15. Has the crisis caused your household to take out or increase an overdraft? By age of youngest child in the household

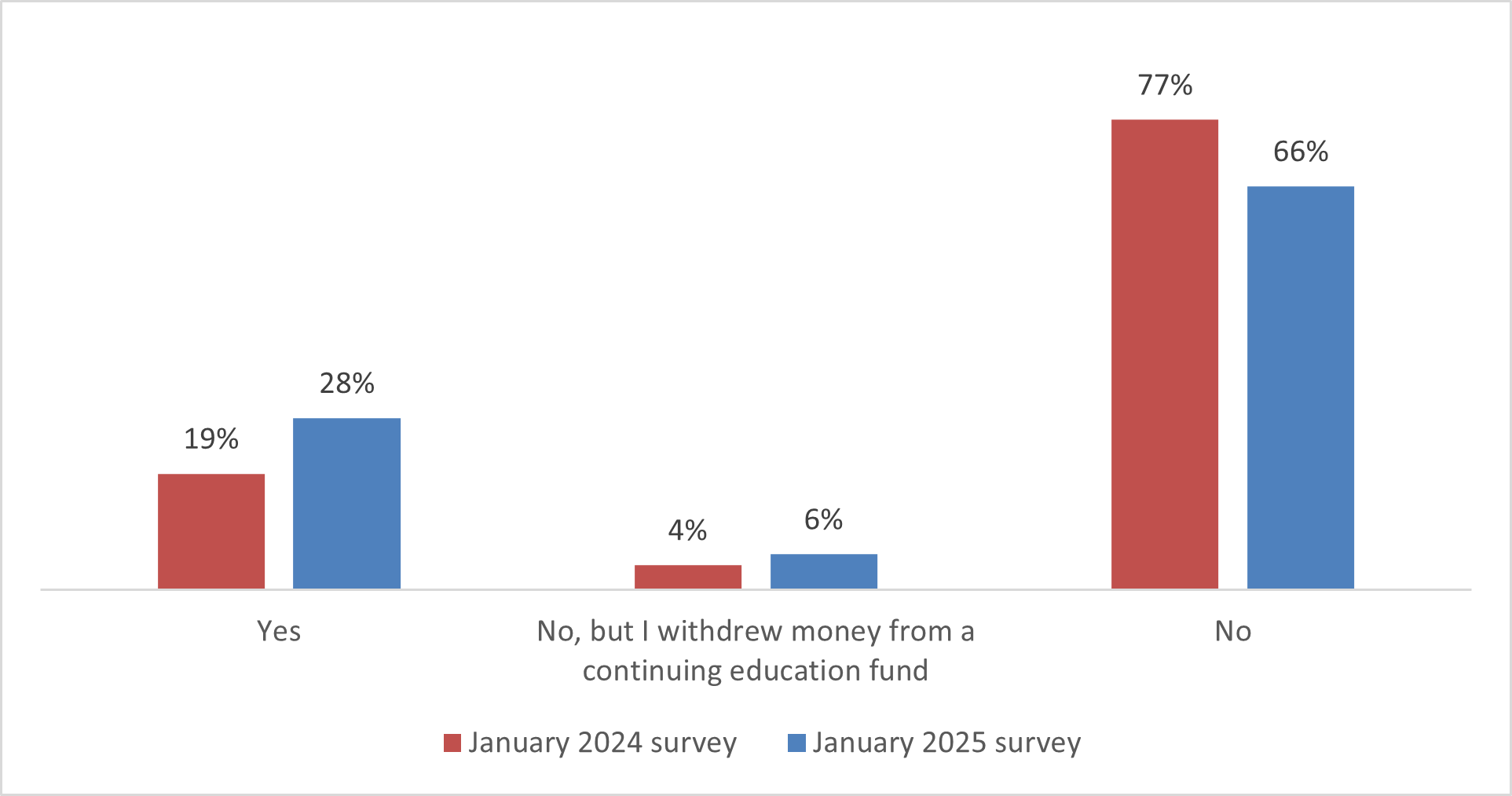

The majority of respondents (66%) have not applied for a loan or been forced to access their savings due to the war, while 28% have taken out a loan since the war began, and 6% have withdrawn money from a continuing education fund.

Relative to the January 2024 survey, there has been an increase in the share of households that have had to borrow money or use their savings due to the war, with the proportion of those taking out a loan having risen from 19% in January 2024 to 28% in January 2025. Concurrently, the share of those that have not needed a loan has fallen, from 77% in January 2024 to 66% in January 2025, indicating growing financial pressure on households over the last year.

Another change has been the slight increase in the share of respondents who have not taken out a loan but have withdrawn money from a continuing education fund—from 4% in January 2024 to 6% in January 2025, indicating that some Israelis are trying to cope with the crisis by using accessible savings instead of taking out a loan.

Figure 16. Have you applied for a loan or accessed your savings since the outbreak of the war? January 2024 and January 2025

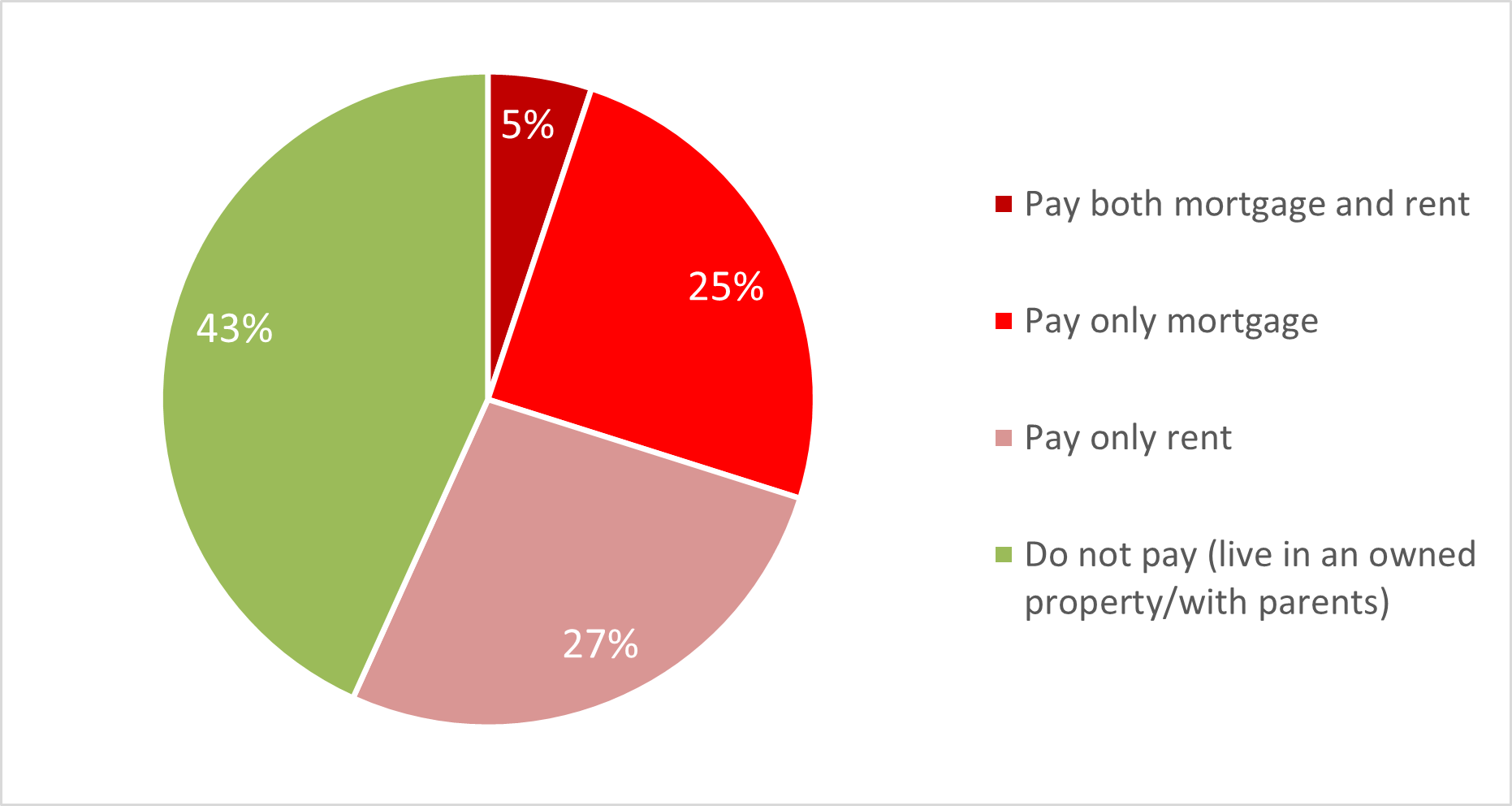

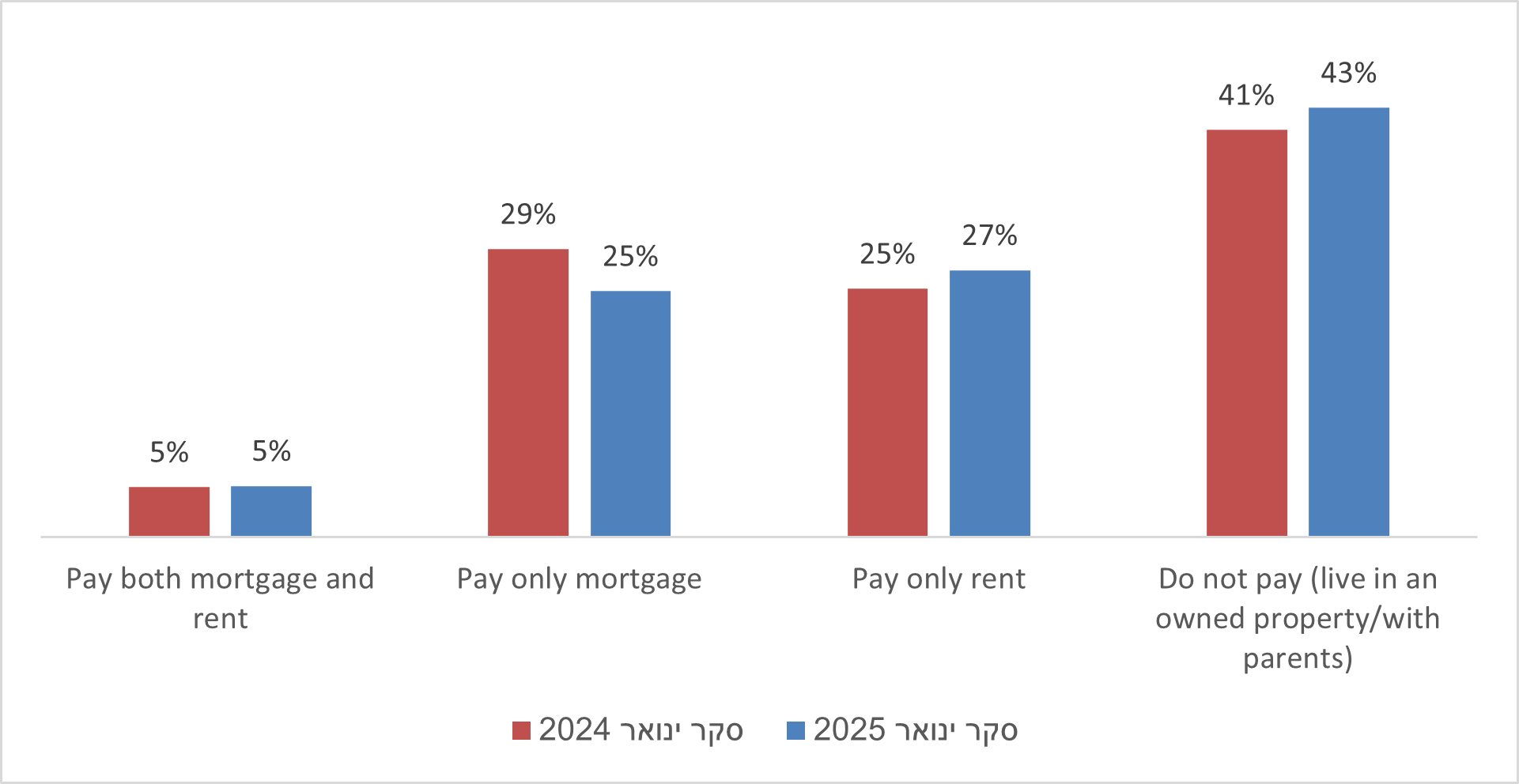

The survey found that 43% of workers do not pay for housing at all; that is, they either live in a property they fully own, or live with their parents or relatives. Some 27% of respondents reported that they pay only rent, while 25% only pay a mortgage. A relatively small proportion (5%) say that they pay both rent and a mortgage, which may indicate either a transitional period between homes or ownership of multiple properties.

Figure 17. Type of payments made for housing

Relative to the January 2024 survey, the distribution of types of payment for housing has remained largely unchanged.

Figure 18. Type of payments made for housing, January 2024 and January 2025

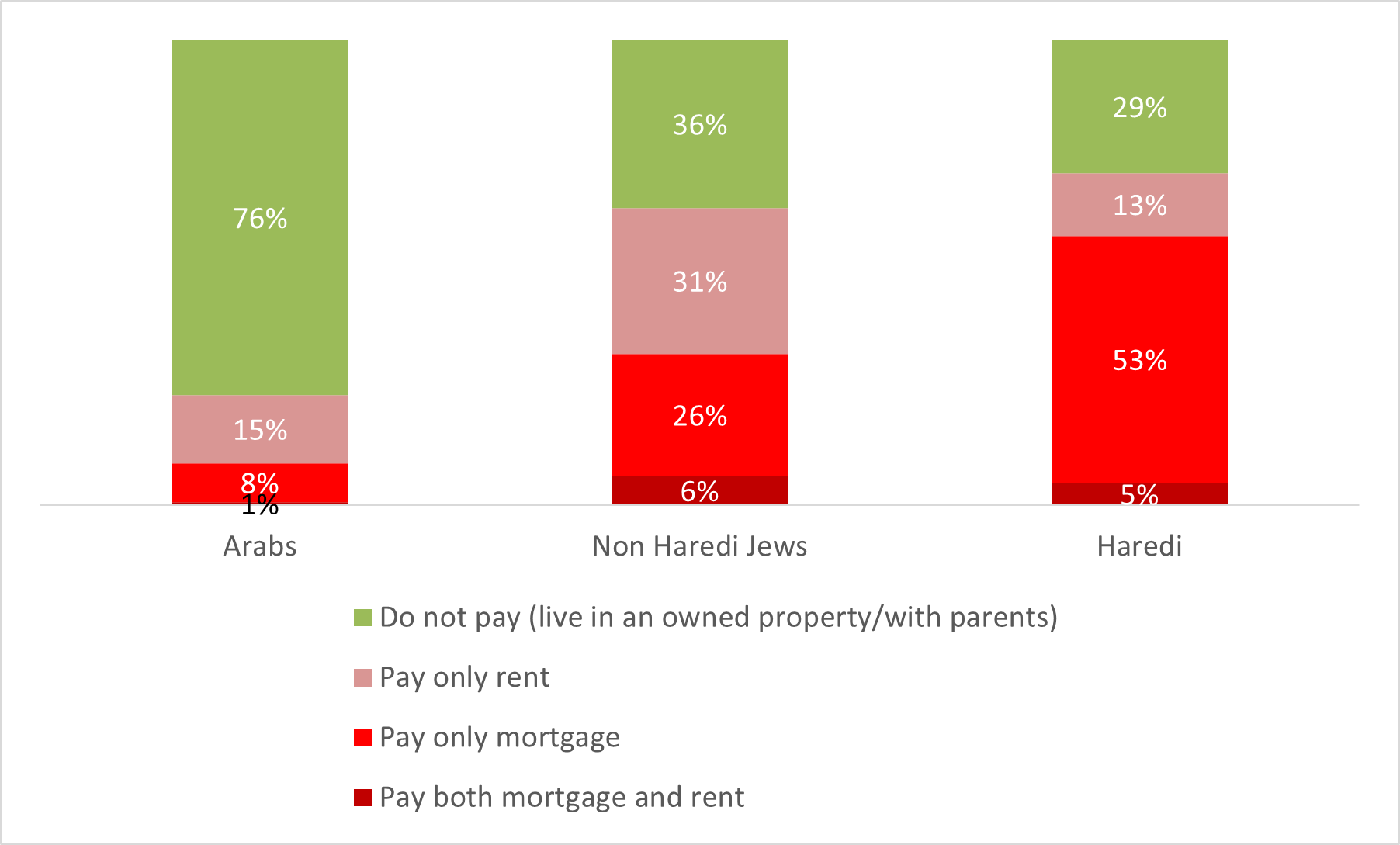

The survey findings reveal significant differences between population groups. The Arab population has a large proportion of workers who do not pay for housing at all (76%), while the equivalent share is lowest among Haredim, at 29%. Among non-Haredi Jews, 36% do not pay for housing. When it comes to respondents who pay only for a mortgage, the largest share by far is found among Haredim, at 53%, compared to 26% of non-Haredi Jews and just 8% of Arabs.

Figure 19. Type of payments made for housing, by population group

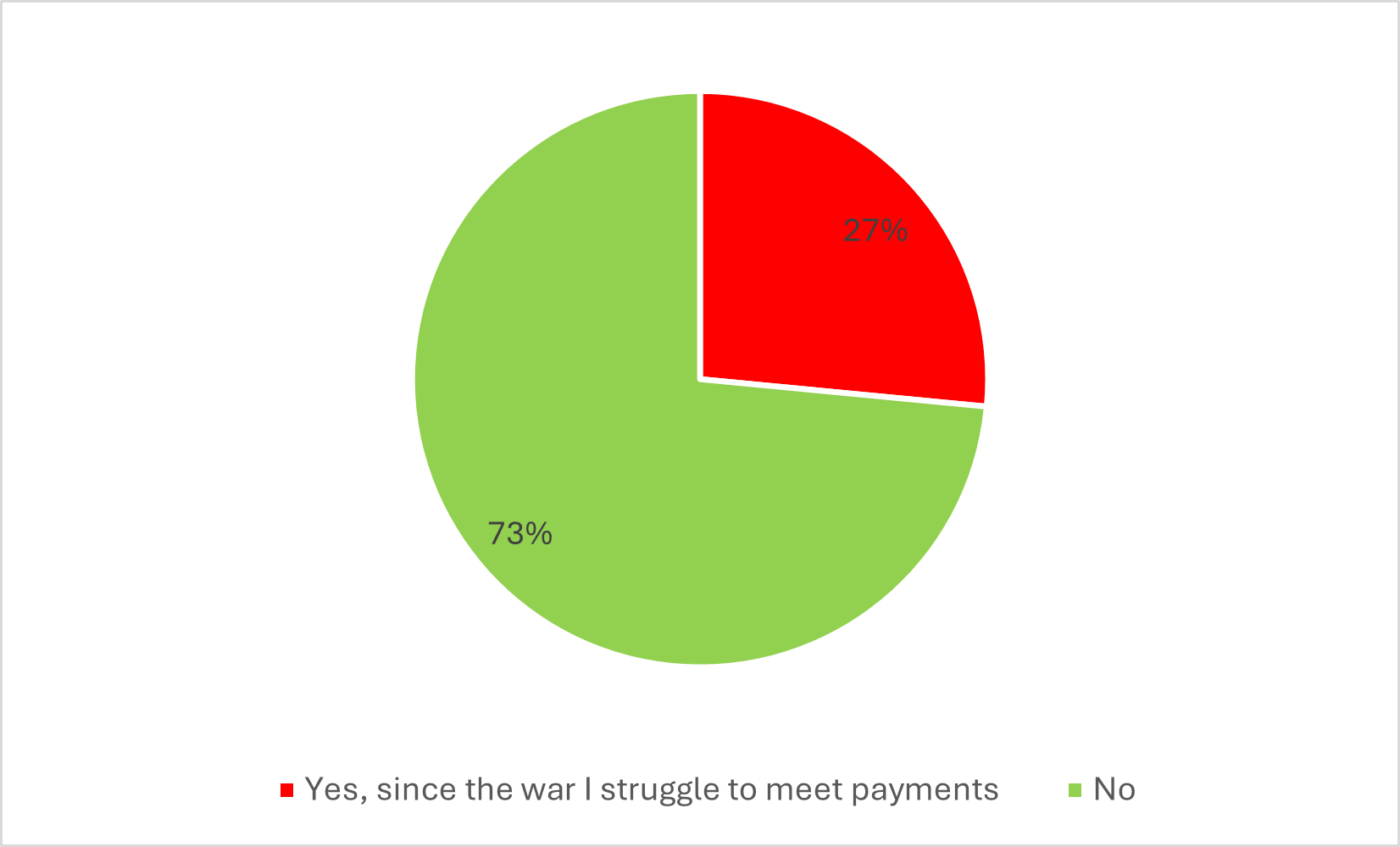

When we asked about the impact of the war on respondents’ ability to meet their housing payments (mortgage and/or rent), 27% said that the war has made it harder for them to meet these commitments, while 73% said that they had not experience significant difficulties.

Figure 20. Has the war had an impact on your ability to meet your mortgage or rent payments (among those who pay for housing)?

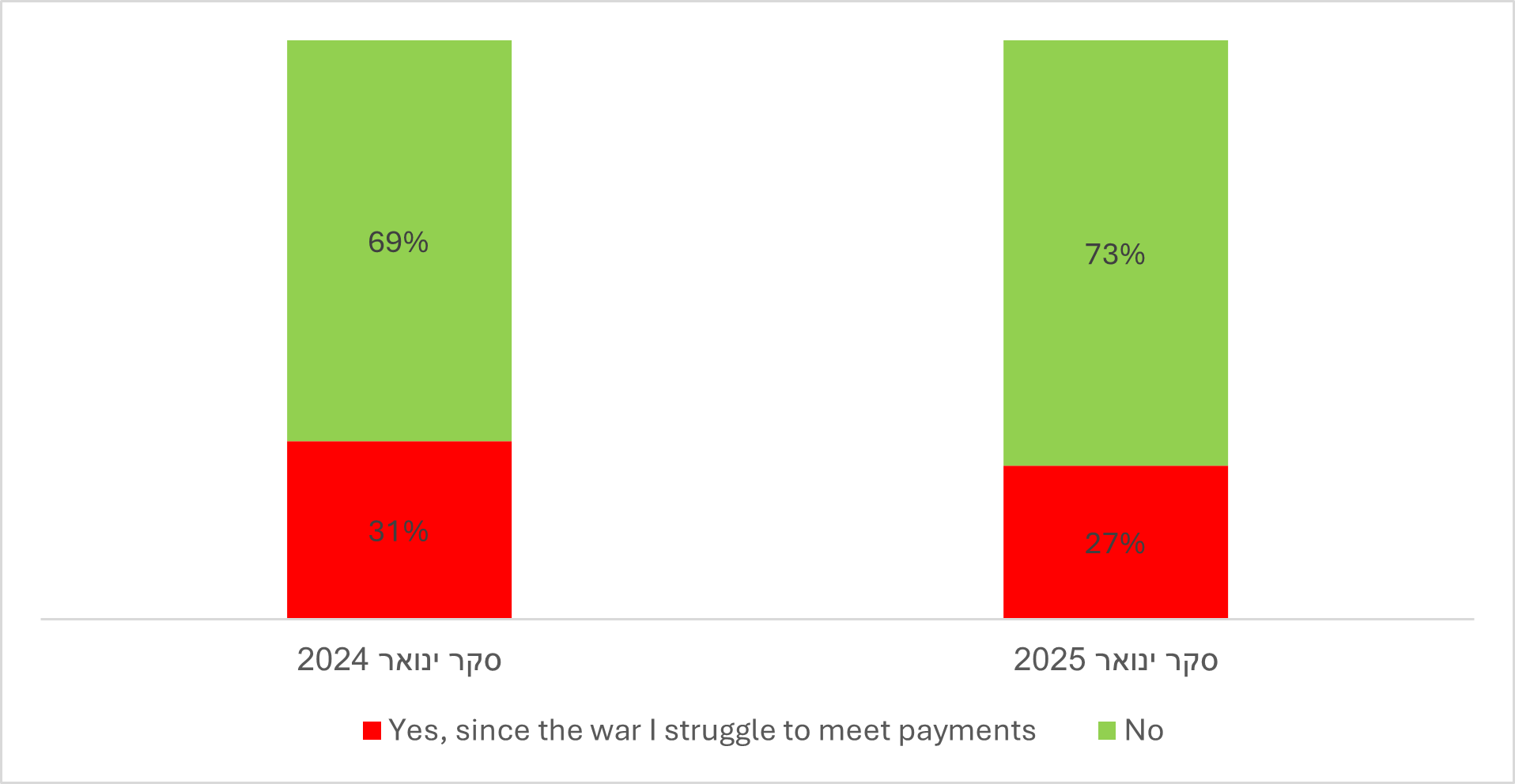

Relative to the January 2024 survey, there has been a slight fall in the share of respondents reporting difficulties in meeting their housing payments (mortgage and/or rent), from 31% in January 2024 to 27% in January 2025. This decline might be indicative of a degree of recovery among some households, or show that renters and those with mortgages have found financial solutions to cope with the situation.

Figure 21. Has the war had an impact on your ability to meet your mortgage or rent payments (among those who pay for housing)? January 2024 and January 2025

[1] It should be noted that the maximum sampling error for the survey is ±2.79%, and thus it would not be wise to draw conclusions from these findings regarding the share of workers in reserve duty. This is an important issue, but is outside the scope of the current survey.

[2] For this survey, “self-employed workers” are those who were in work before the war and in the January 2025 survey did not report that they have closed their business or are serving in reserve duty. Similarly, “salaried workers” are those who were in work before the war and in the January 2025 survey did not report that they are serving in reserve duty, have been dismissed or placed on unpaid leave, or have resigned.

[3] Respondents were asked about their income in November 2024, relative to their income in November 2022.

[4] Who were working before the war

[5] As noted, respondents were asked about their income in November 2024, compared to their income in November 2022.