Judicial Overhaul and Israeli Households

The impact of the proposed changes to the judicial system on the financial balance of Israeli households: analysis of the Ministry of Finance risk scenarios by income deciles

In this report we analyzed the impact result by the risk scenarios presented by the Ministry of Finance on the Israeli households’ financial balance.

The impact of each of the Ministry’s risk scenarios on Israeli households is as follows:

1. Risk Scenario: Negative impact on growth of between 3% and 5%

The Impact on Households

• Damage to the growth of the economy will reduce the GDP and thus lead to a reduction in individual and household incomes.

• In addition, it is reasonable to assume that the negative impact on the hi-tech sector, which along with lowering GDP will also lead to a drop in employment (as also forecast by the Finance Ministry) and will gradually result in a drop in incomes for households in all income deciles.

• It is important to note that the negative impact on the hi-tech sector—which is the engine driving Israel’s economic growth and employs around 12% of the employees in Israel—will not remain a “sector-specific problem.” Rather, reduced growth and activity of Israel’s hi-tech companies will have a negative effect throughout all economic branches (service provision, transportation, food services, financial services, and more). Thus, crisis in the hi-tech industry trickles down to the entire population and may lead to layoffs throughout all the workforce, forcing workers to settle for lower salaries in order to return to work.

2. Risk Scenario: Loss of tax revenues in the amount of NIS 15–30 billion

The Impact on Households

• A loss of tax revenues will force the government to cut the state budget. We anticipate that the government will avoid increasing the budget deficit, due to the risk of Israel’s downgraded credit rating and the resulting increase in the cost of debt servicing and will similarly avoid raising corporate taxation or taxation of high-income individuals for fear of exacerbating Israel’s “brain drain” and of driving foreign and local companies and investors out of Israel, to other countries.

• Thus, we believe that the most likely option will be cuts in public spending, which will lead to a reduction in the scope and quality of public services provided to citizens, and to a reduction in benefit payments.

• Cuts to government-funded public services will force households to fund some of these services (such as education and health) on their own. This will be less adverse for households in higher income deciles, which can afford to purchase health and education services privately, while households in the lower deciles, who are unable to pay for such services, will feel the effects of these cuts much more keenly.

• The reduction of benefits will lead to lower incomes, especially among more vulnerable households, for whom a much larger proportion of their income (almost half) comes from benefit payments.

3. Risk Scenario: Downgrade of Israel’s credit rate

The Impact on Households

• A downgrade of Israel’s rating by international credit agencies will make it more expensive for its government to borrow money and service its debt and will lead to a further rise in interest rates.

• Higher interest rates will increase household expenditure on mortgage payments and other debt repayments.

• Higher interest rates will also increase the cost of corporate financing in the Israeli business sector, harming companies’ profitability and competitiveness in the global markets. Reduced growth of companies in the business sector will also put brakes on the labor market, which will be detrimental to the earning potential of households.

4. Risk Scenario: Depreciation of the Shekel

The Impact on Households

• A depreciation of the shekel will lead to higher prices for imported goods, and services accelerated inflation, and further hikes of interest rates.

• It will mean not only higher prices for imported goods, but also higher prices for Israeli products that use imported raw materials.

• This will result in a significant increase in household expenditure on current monthly consumption, travel abroad, and mortgage payments.

• In addition, the depreciation of the shekel will deal a blow to importers, who are already struggling to cope with the rise in cost of imported goods (in shekel terms) and cannot necessarily pass on the full rate of this increase to consumers—especially not in a time of economic uncertainty among households.

5. Risk Scenario: Increased costs of raising government debt (the yields governments' bonds)

The Impact on Households

• The increased costs of government debt will lead to a rise in the yields of government and corporate bonds, higher corporate financing costs in the business sector, and as a result-decrease in capital market.

• In turn, this will produce lower yields for individuals and households on their investments (pension funds, savings funds, and other savings linked to the capital market), as well as a drop in the value of the public’s financial assets.

• The result will be a decline in household income from these sources.

Source: Data analysis conducted by the Israel Democracy Institute on Central Bureau of Statistics data in its 2019 Surveys of Incomes and Expenditure.

1. Characteristics of the “123” Israeli Family

The average family in the lowest income deciles [1–3], 2019 baseline:

• Net household income: NIS 5,467 per month

• Net household expenses: NIS 7,106 per month

• Monthly financial balance (income minus expenses): NIS –1,639

• Proportion of Arab households: 22%

• Proportion of households with debt (mortgages and other): 21%

• Median leverage ratio (ratio of household debt to annual household income): 1.5

• Average number of persons per household: 2.4

• Average number of breadwinners per household: 0.6

• Average age of head of household: 53

• Average number of years of education of head of household: 12.7

2. Characteristics of the “456” Israeli Family

The average family in the middle-to-low-income deciles [4–6]: 2019 baseline)

• Net household income: NIS 12,862 per month

• Net household expenses: NIS 11,334 per month

• Monthly financial balance (income minus expenses): NIS 1,528

• Proportion of Arab households: 15.7%

• Proportion of households with debt (mortgages and other): 39%

• Median leverage ratio (ratio of household debt to annual household income): 0.6

• Average number of persons per household: 3.2

• Average number of breadwinners per household: 1.4

• Average age of head of household: 47

• Average number of years of education of head of household: 13.6

3. Characteristics of the “789” Israeli Family

The average family in the middle-to-high income deciles [7–9], baseline: 2019)

• Net household income: NIS 22,847 per month

• Net household expenses: NIS 16,694 per month

• Monthly financial balance (income minus expenses): NIS 6,153

• Proportion of Arab households: 12%

• Proportion of households with debt (mortgages and other): 54%

• Median leverage ratio (ratio of household debt to annual household income): 0.9

• Average number of persons per household: 3.9

• Average number of breadwinners earners per household: 2

• Average age of head of household: 45

• Average number of years of education of head of household: 14.9

We conducted several simulations to assess how the financial situations of the three family categories presented above are liable to change, if the proposed reforms to the judicial system are carried out, and the risk scenarios for their macroeconomic consequences as prepared by the Finance Ministry come to pass. These simulations examined the situation of each of these family categories, on the assumption that each is making mortgage payments according to the averages found in the Central Bureau of Statistics’ household expenditure surveys.

It is important to stress that these are not forecasts, but rather examinations of possible scenarios that are based on various assumptions regarding the main parameters that will impact the financial situation of Israeli households in everyday life.

The following are the details of the scenarios examined in our simulation:

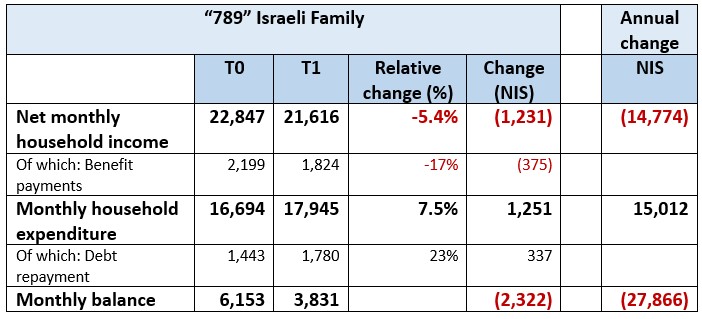

1. Changes in the Financial Balance of the “123” Israeli Family (based on simulation)

The main changes revealed by the simulation of changes in the financial situation of an average family (with a mortgage) in the lowest income deciles (1–3), were as follows:

• Net monthly household income will drop by around NIS 700, mainly due to cuts to benefit payments.

• Monthly household expenditure will increase by around NIS 400, mainly due to rises in prices and in mortgage payments.

• The monthly household deficit (income minus expenditure) will increase by around NIS 1,100.

• The annual household deficit (income minus expenditure) will increase by around NIS 13,150.

• In addition, if families in the lowest income deciles are forced to increase their private expenditure on public services (such as education and health), their monthly deficit will be even larger than that shown above.

Financial balance of an average family (with a mortgage)

Source: Processing carried out by the Israel Democracy Institute of data provided by the Central Bureau of Statistics in its 2019 Surveys of Incomes and Expenditure. RATHER THEN WRITE THIS Each time, better to write in the first citation that all the following analyses are based on….unless this isn’t the same as “household expenditure surveys” cited above.

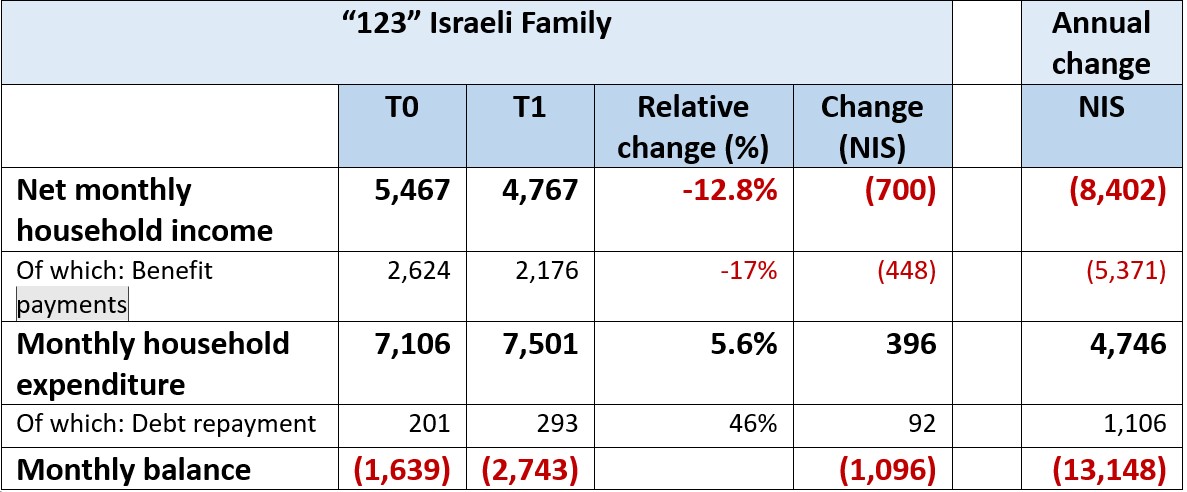

2. Changes in the Financial Balance of the “456” Israeli Family (based on simulation)

The main average changes in the situation of families revealed in the simulation: income deciles (4–6), with a mortgage, were as follows:

• Net monthly household income will drop by around NIS 875, in large part due to cuts to benefit payments.

• Monthly household expenditure will increase by around NIS 685, mainly due to rises in prices and in mortgage payments.

• The monthly household surplus (income minus expenditure) will drop by around NIS 1,560.

• The annual household surplus (income minus expenditure) will drop by around NIS 18,700.

• In addition, if families in the middle-to-low-income deciles are forced to increase their private expenditure on public services (such as education and health), their monthly surplus will be even smaller than that shown above.

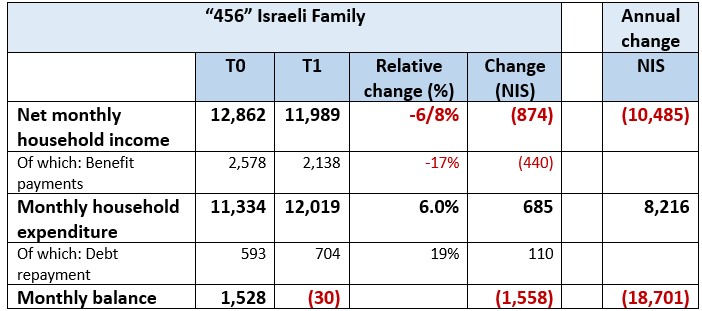

3. Changes in the Financial Balance of the “789” Israeli Family

The main average changes found in the simulation to examine the change in financial situation of an average family in the middle-to-high income deciles (7–9), with a mortgage, were as follows:

• Net monthly household income will drop by around NIS 1,070.

• Monthly household expenditure will increase by around NIS 1,250, mainly due to rises in prices and in mortgage payments.

• The monthly household surplus (income minus expenditure) will drop by around NIS 2,320.

• The annual household surplus (income minus expenditure) will drop by around NIS 27,870.

• In addition, it is reasonable to assume that private expenditure on public services (such as education and health) will increase by hundreds of shekels per month, so that the monthly surplus will decrease accordingly, to an even greater extent than indicated above.