Financial Literacy

Chap. 6

Data from the Central Bureau of Statistics (CBS) Social Survey indicate there are substantial gaps in financial behavior and economic preparedness between ultra-Orthodox Jews and non-Haredi Jews.

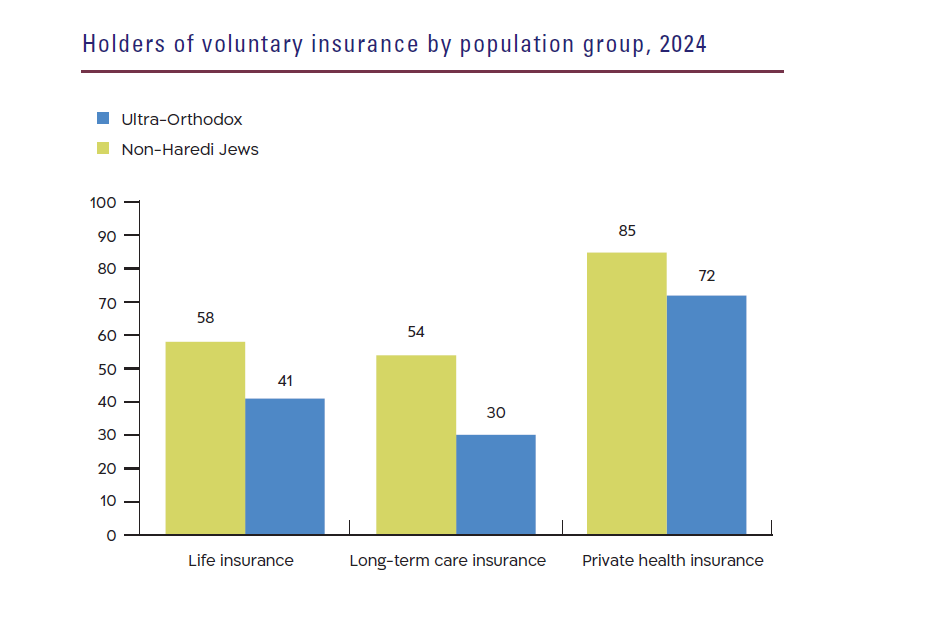

Overall, Haredim are less financially resilient. Members of the ultra-Orthodox community save less than non-Haredi Jews, and even when they do save, many tend toward savings frameworks that lack real yields. Rates of voluntary insurance coverage—such as private health, long-term care, and life insurance are significantly lower among Haredim, as is confidence in their ability to cope with income loss.

Preparation for retirement is also weaker, and retired Haredim rely on a narrower range of income sources.

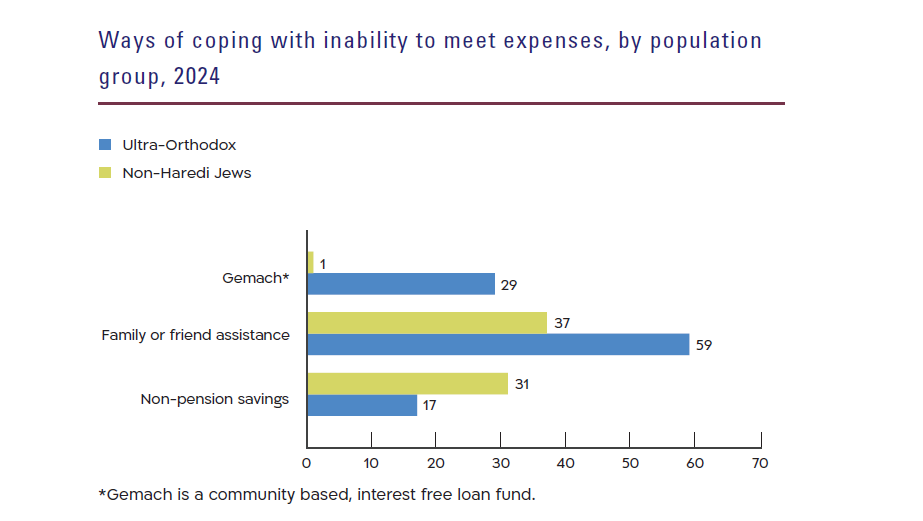

Haredim carry higher financial liabilities: 41% report having a mortgage and 36% additional loans, compared to 29% and 28%, respectively, among non-Haredi Jews. In times of economic distress, they rely more heavily on family and community support networks. Only 41% believe they could manage an unexpected expense without family assistance, compared to 63% of non-Haredi Jews.

Differences are also evident in routine financial management. Haredim make greater use of debit-based payment methods and are less likely to use standard credit cards. Participation in capital market savings is particularly low (11% versus 28% among non-Haredi Jews), and digital financial literacy, such as using comparison tools or online pension information platforms, is more limited. Despite these objective gaps, subjective perceptions are similar: roughly one-quarter of both Haredi and non-Haredi Jews report satisfaction with their economic situation, reflecting a divergence between measured financial security and self-assessment.